FEATURED STORY

How the Big 12 Will Survive the NIL Financing Era

Happy New Year! Welcome to what might be the most consequential year in the business of sports.

The start of the year means the College Football Playoff is in full swing. Indiana steamrolls Bama. Ole Miss takes down Georgia in a game that will live on in CFP lore.

Big moments for the Big Ten and SEC.

But what about the Big 12?

In light of Texas Tech Football getting shut out in their first College Football Playoff appearance by Oregon, the Big 12’s competitiveness is now under serious review.

And if you needed more proof, look no further than Arizona State head coach Kenny Dillingham publicly pleading for a wealthy Phoenician to “stroke a $20M check right now.”

The problem is simple:

It’s the money.

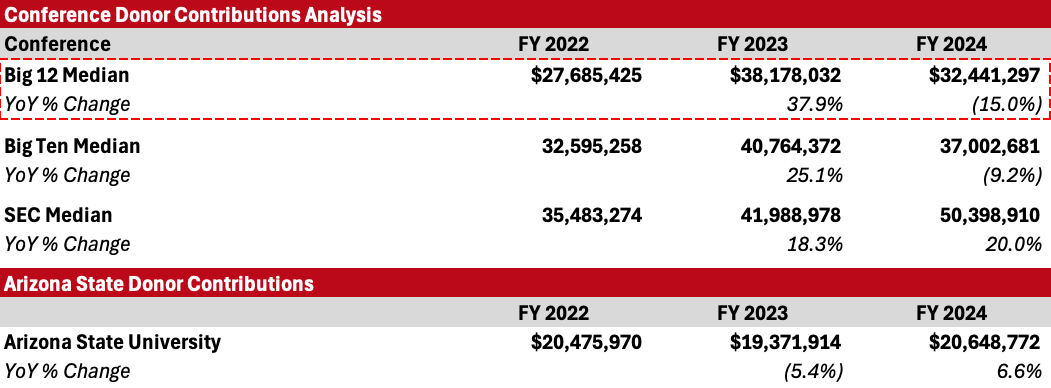

Not only are Big 12 donor contributions already trailing the Big Ten and SEC – they’ve declined meaningfully year-over-year.

We used public data from the Knight-Newhouse College Athletics Database to conduct our own financial & data modeling for this piece – hope this analysis paints a clearer picture:

Donors are wearing thin after spending unprecedented amounts of money with unclear returns, while demand continues to rise. At this rate, relying on university-backed collectives alone won’t be nearly enough to close the widening NIL gap with the SEC and Big Ten.

What about media rights?

The Big 12 is currently in year one of a six-year, $2.3B media rights extension (~$380M/yr) that runs through the 2030-31 season. It’s a meaningful step up from the conference’s prior deal (~$200M/yr).

But relative to the competition, it’s still not enough:

The Big Ten earns roughly ~$1.15B per year

The SEC pulls in about ~$710M per year

And now, there’s a new constraint.

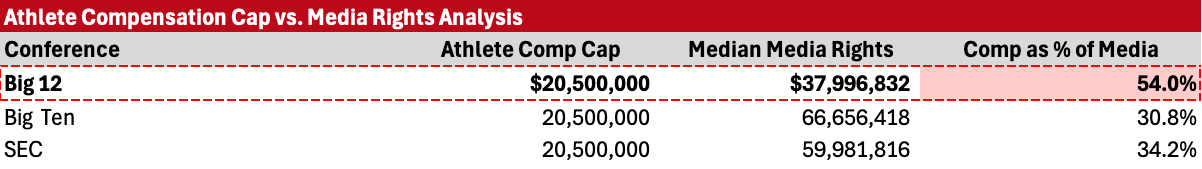

Following House v. NCAA, universities must prepare to directly compensate athletes up to ~$20.5M annually – roughly 22% of the average Power Five athletic department’s revenue.

For the Big 12, the math is brutal.

To compete with the best, roughly 54% of a school’s annual media distribution would need to be allocated to athlete compensation alone – leaving little room to invest in facilities, staff, or long-term program development:

To keep its schools competitive, the Big 12 has been forced to think beyond traditional media rights and donor support.

And that’s exactly where the Big 12 went on the offensive over the final five weeks of 2025, striking three pivotal deals.

Let’s break them down.

Deal 1: Secure a Long-Term Investing & Operating Partner

According to Front Office Sports, The Big 12’s $500M agreement with College Athletic Solutions (CAS) – a college athletics investment platform backed by RedBird Capital and Weatherford Capital – is designed to inject immediate capital into the conference while professionalizing how it generates revenue from its assets.

Here’s what CAS provides:

$25M investment into Big 12’s for-profit commercial arm (Big 12 Properties)

Up to $30M per school, available on an opt-in basis

Operational support to help unlock new revenue streams beyond traditional media rights

In exchange, CAS receives a layered economic package:

Revenue participation tied to conference performance, capped at 15%

10% commission on commercial sponsorships and bespoke partnerships it sources for the Big 12

Interest and principal repayments from participating schools, enforced by withholding a portion of conference distributions

A potential $2.5M annual retainer for its services

In substance, this is a private credit deal, not an equity transaction.

It’s a bold-but-necessary step towards professionalizing Big 12 operations and bringing university athletic P&Ls back under control.

In a world where college athletic departments are increasingly treated like professional sports businesses, we analyzed the viability of each public Big 12 school using pure operating revenue – excluding donor contributions, student fees, and university subsidies.

The results are staggering.

In FY24, Big 12 athletic departments ran at $50M+ average operating losses, with approximately 72% loss margins on core operations:

Put simply, these are not sustainable, for-profit enterprises.

To right the ship, the Big 12 must materially increase its media, sponsorship, and commercial distributions – that‘s the bet being placed on CAS.

The conference has already pointed to early traction from RedBird Capital’s ecosystem, having delivered $145M+ in contracted revenue to the Big 12 and its members.

At the university level, the optional $30M capital infusion can be deployed to:

Stabilize near-term operating budgets

Renovate facilities to improve athlete experience

Invest in fan engagement infrastructure that compounds revenue over time

The University of Utah has already stricken its own deal with Otro Capital to fund athletic infrastructure and commercial growth.

The Big 12 is now democratizing access to a similar type of capital. For many schools, the optional $30M serves as a proof of concept rather than the endgame. If the model works, it wouldn’t be surprising to see universities eventually pursue their own bespoke private equity and operating partnerships of their own.

Deal 2: Diversify Revenue Streams Via New Content

The Big 12 recently secured a partnership with Players Era – a for-profit, NIL enabled college basketball tournament held annually in Las Vegas.

Think of Players Era as an early-season version of March Madness (minus the bracket). It’s invite-only, allowing the tournament to prioritize high-profile programs and marquee talent – the teams most likely to drive viewership, sponsorship interest, and revenue.

Under the agreement, the Big 12 receives:

A 15% equity stake in Players Era

Eight automatic bids for Big 12 teams, each with a guaranteed $1M NIL payout

At least $50M in rights fees for its basketball programs over the next six years

The tournament has two structural advantages.

First, it’s built as standalone sports IP – with its own media rights, corporate sponsorships, and on-site hospitality – rather than operating like a traditional NCAA-controlled event.

Second, guaranteed NIL payouts materially change school incentives. Athletic departments can rely less on donor collectives to compensate players, making buy-in easier and participation more predictable. In that sense, Players Era fills a unique role in college basketball while ensuring top programs consistently show up.

By taking an equity stake, the Big 12 owns a piece of differentiated content outside of its core media rights. It’s a scalable asset, with upside tied directly to growth, and guaranteed national exposure for eight Big 12 programs every year.

Deal 3: Making A Long-Shot Bet to Become a Global Brand

A news item that largely flew under the radar – but could carry real (albeit long-shot) implications for the future of football – is the Big 12’s new strategic partnership with the NFL.

The agreement spans multiple areas, from joint officiating training to shared testing of player-tracking technology. But the most forward-looking – and opportunistic – element is the joint effort to grow flag football within Big 12 schools.

By leveraging NFL Flag’s infrastructure, Big 12 universities can begin incubating legitimate collegiate flag football programs on campus.

There’s massive tailwinds for the sport to go global:

Flag football will debut at the 2028 Olympics

The NFL and 32 Equity recently committed $32M to launch a men’s and women’s professional flag football league

Tom Brady and other NFL stars are set to compete in the Fanatics Flag Football Classic in Riyadh this March

Flag football has a credible path to becoming a global sport. And the Big 12 sees an opportunity to get out in front – building institutional infrastructure early while investing is accelerating.

Because it’s Olympic-backed and inclusive of women’s competition, flag football introduces entirely new demographics into the ecosystem. That may prove critical in international markets where traditional American football has little cultural footing.

And if professional flag football begins to draw viewership, it raises a natural question:

Could collegiate programs follow?

If so, the Big 12 has an early opportunity to capture global attention of football by positioning itself as a first mover in a new, globally exportable version of football.

Final Thoughts

It’s times when an organization’s back is against the wall that innovation accelerates. The Big 12 has taken three distinct and unconventional swings that forges a credible path to resurgence.

While the conference has fallen behind the SEC and Big Ten on raw dollars, the underlying structural challenges are the same ones those leagues are already confronting – or will soon.

Over time, it’s likely we see the SEC & Big Ten pursue their own bespoke strategic partnerships, take equity stakes in content platforms, and tap institutional capital when the moment demands it.

Consider this an early signal of where college sports is heading.

If you’d like to learn more about how conferences are positioning themselves in the NIL era – or want a deeper analysis – feel free to hit reply!

↓

LEAGUES & TEAMS

Photo: The Pac-12 is relaunching with new nine-member lineup this July.

The Pac-12 secures a nine-member lineup and new media deals for its 2026 relaunch (Jan. 1st)

Conference expands from two (Oregon State & Washington State) to nine, locking in media packages with CBS, The CW, and USA Sports

OSU & WSU win control of conference rights; league retains a ~$100M war chest via litigation, rebuilt governance, and launched Pac-12 Enterprises production arm [FOS]

TMRW Sports announces launch of women’s TGL league (WTGL) in partnership with the LPGA (Jan. 6th)

WTGL to debut post-2026 LPGA season, operating out of TGL’s SoFi Center

League to mirror TGL format with city-based franchises, regular season, and playoffs; TMRW is reportedly in talks with prospective ownership groups, sponsors, and media partners [WTGL]

Man City City owner City Football Group exits its 65% Mumbai City FC stake ahead of ISL risk (Jan. 2nd)

Stake divestment (acq. 2019) returns control to founding owners Ranbir Kapoor and Bimal Parekh

Exit follows ISL uncertainty following ₹700 crore ($77.7M) AIFF–FSDL rights deal expiration with no renewal [SportsPro]

British investment management firm Lindsell Train cuts its Manchester United stake by 18% via secondary share sales (Jan. 6th)

LT unloads 780K shares in Q4 2025, reducing its Class A stake from 7.8% to 6.4%; firm has trimmed its position every quarter since Ratcliffe’s 25% entry in 2024 [Sportico]

Former Real Madrid star Sergio Ramos heads a €400M ($469M) bid to buy Spanish club Sevilla FC (Jan. 3rd)

Offer targets 100% of Sevilla at enterprise value; price hinges on ~€180M debt audit

Bid backed by foreign investors, including an American fund; Ramos acts as public face, not lead investor [TheAthletic]

New England Revolution owner The Kraft Group reaches deal with Boston/Everett cities for a new stadium (Jan. 2nd)

Advances plan for a 25K-seat waterfront stadium and 43-acre Mystic River public park

Krafts commit ~$50M+ in direct payments, transit upgrades, environmental remediation, and community benefits over 15 years; deal requires state and local permits [Sportcal]

General Atlantic agrees to acquire a 49% stake in Mexican soccer holdco Ollamani Group for ~$240M (Dec. 23rd)

Syndicate to acquire 49% of the Club América and Estadio Azteca owner; deal includes a data management and consulting partnership with Kraft Analytics Group

New Grupo Águilas entity valued at $490M; Atlantic’s stake valued at ~$240M [GeneralAtlantic]

NBA, FIBA advance plans for prospective NBA Europe franchises (Dec. 22nd)

NBA-FIBA JV will begin engaging prospective teams and ownership groups this January

League blends permanent franchises with merit-based domestic qualification; JV includes financial support for FIBA-affiliated European leagues, academies, and player development [FIBA]

NBA All-Star Ben Simmons acquires a 50% stake in Sport Fishing Championship team ‘South Florida Sails Angling Club’ (Dec. 23rd)

Deal values the SFSAC in the ‘high seven figures’, per SFC commissioner

Ownership group includes Lonnie Walker IV; Simmons joins Terrence C. Murphy, Scottie Scheffler, and Randy Moss, among other high-profile SFC athlete investors

Simmons’ investments include Faze Clan, Reel One Fishing Club, and Hyperice [BleacherReport]

International Swimming League, a team-based pro swimming circuit, plans a 2026 relaunch following a three-year hiatus (Dec. 22nd)

New commercial model reduces reliance on a single backer (Ukrainian businessman Konstantin Grigorishin), shifting toward sponsorship and media deals

League targets 2026 autumn return (2027 fallback) with events across North America, Europe, Asia; hiatus due to the COVID and Russia-Ukraine war aftermaths [Reuters]

↓

STARTUPS & VENTURE CAPITAL

Photo: Conor McGregor-backed MMA.Inc raises Series A funding led by American Ventures.

MMA.Inc, a Conor McGregor-backed combat sports tech platform, raises $3M in Series A funding led by Trump-backed American Ventures (Jan. 5th)

AV leads a $3M private placement; Dominari Securities acts as placement agent; Includes option for investors to buy up to an additional $20M in equity

Proceeds will drive digital and platform initiatives as MMA.Inc positions as tech-led, not a fight promoter [InsiderSport]

Kinotek, a B2B SaaS movement analysis platform used by pro sports teams and modern fitness operators, raises $2M in post-seed equity funding (Jan. 5th)

Uses motion-captures technology to provide visuals & key metrics on mobility, imbalances, and overall quality of movement

Investment led by Maine Venture Fund [Athletech]

↓

M&A

Photo: KKR acquires sports PE fund Arctos at a $1B valuation.

KKR agrees to acquire sports PE investment firm Arctos Partners in a ~$1B deal (Jan. 6th)

Management incentives could lift total consideration closer to $1.5B

Arctos manages $14B+ AUM with 20+ minority stakes across all five major US leagues; portfolio includes Bills, Dodgers, Warriors, Fenway Sports Group, and Harris Blitzer S&E, among others [Bloomberg]

CVC Capital’s GSG reportedly nears external investment for its $14B Global Sport Group portfolio (Dec. 30th)

New capital expected to fund acquisitions into leagues and governing bodies, not clubs

Move follows refinancing talks with Ares Management; Goldman Sachs, Raine Group, and PJT Partners reportedly advising CVC [CityAM]

Global Media & Entertainment, a UK commercial radio giant, acquires majority stake in Gary Neville’s YouTube media network ‘The Overlap’ (Jan. 6th)

Deal gives Global majority control from global marketing firm Miroma Group

The Overlap reaches 38M+ monthly YT views, generated 2.2B total views across platforms last year, and owns UK rights to stream one weekly Bundesliga match [Global]

Gabelli Funds, a research-driven asset manager, launches sports-focused ETF offering retail access to pro sports assets (Jan. 7th)

Gabelli Opportunities in Live and Sports ETF (GOLS) debuts with under $11M in AUM; Gabelli to publish fund holdings daily and provide daily liquidity for retail investors

Fund provides exposure to assets including MSG, Atlanta Braves, F1 (Liberty Media), and Man United, among others [Sportico]

Warner Bros. Discovery rejects altered Paramount takeover bid to pursue Netflix merger (Jan. 7th)

WBD calls revised offer inferior, citing leverage risk and uncertainty; Paramount is expected to take on D/E financing 7x its market cap

Proposal values WBD at $108.4B EV vs. WBD’s $82.7B studio-and-streaming deal with Netflix; second bid provides a personal financial guarantee from Larry Ellison [Reuters]

Topgolf Callaway Brands, a golf-tech and equipment company, completes its majority stake sale in Topgolf to Leonard Green at a ~$1.1B valuation (Jan. 5th)

TCB sells 60% of Topgolf/Toptracer; retains a 40% minority stake

Company receives ~$800M in net cash proceeds and repaid $1B of term loan debt; leaves ~$480M in debt and ~$680M in cash; $200M share repurchase authorized [TopgolfCallaway]

↓

STRATEGIC VENTURES

Photo: WWE archives will now stream on Netflix U.S.

[Archive Rights] WWE expands its Netflix partnership in non-exclusive US archive streaming deal; The Rest is Football secures Premier League archive rights for video-first podcast; Paramount+ launches UFC classic fights hub ahead of first event under new deal (Jan. 6th-7th)

Netflix becomes the US home for WWE’s full pre-Sept. 2025 premium live event archive

Gary Lineker’s Goalhanger licensed footage from every Premier League match from 1992-May 2025 for new highlights series Premier League Greats: The Moments That Made Them; marking the first podcast to show official Premier League footage

WPP Media, a global media collective, launches a dedicated sports practice ‘WPP Media Sports’ to guide rising ad spend (Jan. 6th)

WPPMS will advise brands on sports ad strategy, investment, and data-driven buying

Offering spans analytics, sponsorship activation, partnerships, and influencer-led content production [Variety]

Paris Saint-Germain (PSG) taps computer vision virtual coach app Zing Coach to launch player-inspired fitness programs for fans (Jan. 6th)

Deal through 2027 gives fans adaptive workouts modeled on PSG players via app

Gamified experience includes leaderboards, progress tracking, and VIP rewards with signed memorabilia; move follows Zing Coach’s $10M Series A in 2024 [ZingCoach]

Trophée des Champions becomes the first European soccer match with live AI-translated commentary via Camb.AI (Jan. 6th)

Lenovo unveils ‘Football AI Pro’ among other 2026 World Cup activations across logistics and fan experience (Jan. 6th)

Firm unveils real-time match insights (Football AI), upgraded VAR displays, and referee view – powered by 3D context and Gen AI for offside calls and broadcast analysis

Smart wayfinding, command center, and FIFA-branded Lenovo devices to improve fan and operational experience [SBJ]

Ohio State and college sports marketing firm Learfield expand MMR deal through 2036 (Jan. 7th)

Deal builds on 2019 deal; includes the continued operation of Buckeye Sports Group (NIL), expanded revenue generation opportunities, and partnerships [Learfield]

Under Armour partners with Malaysian company StarCruises to launch a fitness-focused cruise (Jan. 6th)

Fitness @ Sea offers a four-night active-lifestyle cruise spanning Port Klang, Phuket, and Singapore

Features complimentary workouts: Animal Flow, Pilates, Beast Mode, with on-board certified trainers; Move follows the HYROX Cruise announcement set for 2026 [Athletech]

PitchCom, an on-field communications tech platform, partners with Sportradar’s Synergy Sports in a multiyear college baseball and softball data-sharing deal (Jan. 7th)

Deal integrates PitchCom intent data into Synergy’s video/analytics platform, enabling colleges and pro scouts to quantify pitcher command

Move expands PitchCom’s footprint beyond MLB into NCAA baseball/softball scouting workflows [SBJ]

↓

JOB BOARD

If cutoff & you’d like to see the entire list - click to view this newsletter in browser!