FEATURED STORY

Why the NBA Sees an Opportunity, and Why the EuroLeague is Fighting Back

Globalization is a sports investor’s favorite macro trend, and one that has reshaped the modern sports ecosystem.

The playbook is simple: take a commercially proven sports property and scale it across borders into under-monetized but structurally lucrative markets.

The NFL now plays regular-season games across Europe, Latin America, and soon Australia. MLB staged the Dodgers vs. Cubs in Tokyo. Even professional cricket has entered the U.S. through Major League Cricket.

But exporting a proven product is one thing.

What happens when you try to build a brand-new league in an international market that already has a powerful incumbent?

We’re now watching that question play out in real time with NBA Europe.

What’s Going on With NBA Europe

Treat this week’s newsletter as your everything-you-need-to-know primer on NBA Europe.

Let’s start with some basic context:

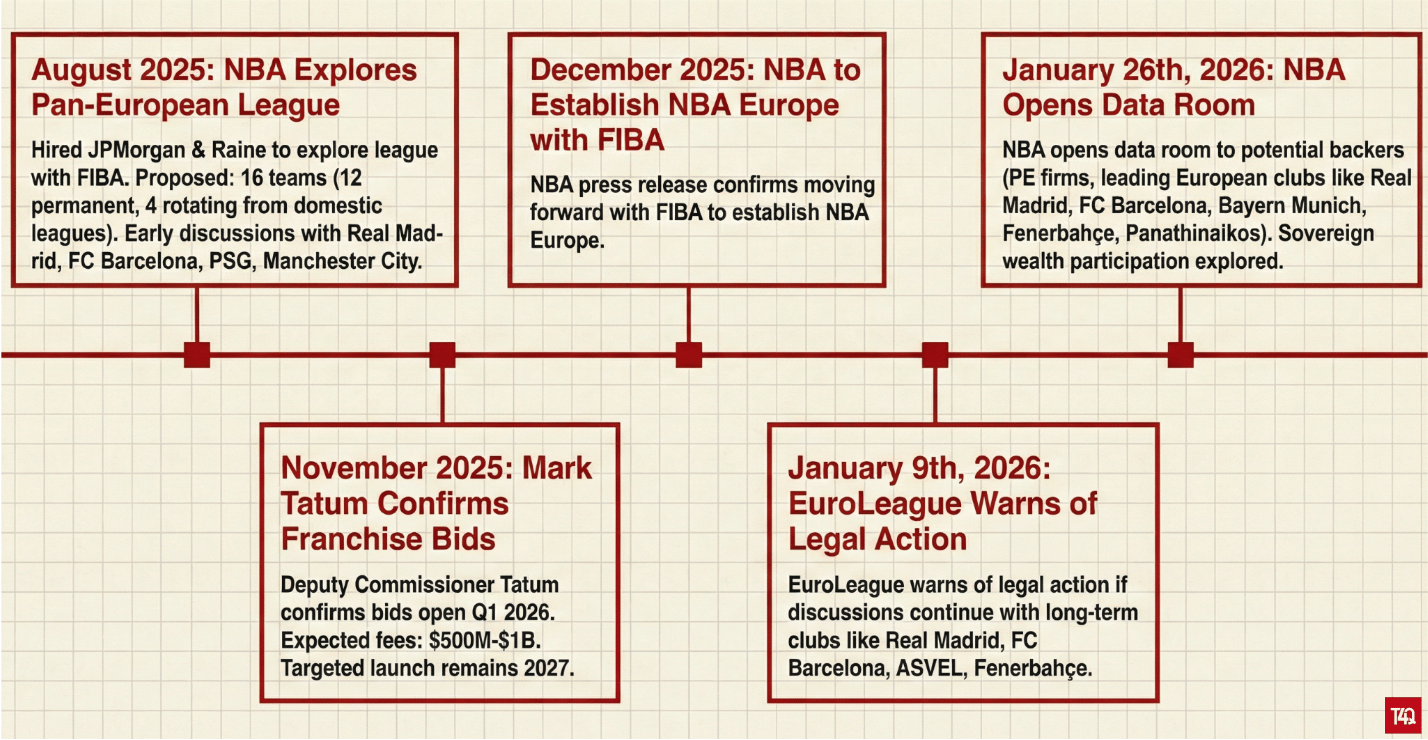

Sources in Order of Timeline: August, November, December, January 9th, January 26th.

Momentum is building, with major private equity firms and global sports brands increasingly enticed by owning an NBA Europe franchise.

However, the European basketball market is already mature.

And the EuroLeague refused to back down, threatening legal action against the NBA.

Why NBA Saw an Opportunity

Before we talk about EuroLeague’s legal positioning, let’s talk about why the NBA is so interested in Europe to begin with.

Basketball is the second most popular sport in Europe with more than 270M fans.

And the underlying market is compelling. European sports fandom is deeply entrenched in local communities while also producing globally recognized brands like Real Madrid, FC Barcelona, and PSG. The talent pipeline is strong and the rivalries feel almost tribal.

Yet the EuroLeague has struggled to build a self-sustaining business model. Its teams reportedly burned a combined €200M annually, relying on wealthy owners and institutional investors to stay afloat.

Here’s what they’re dealing with.

First is brand disaggregation.

It’s the continent’s natural complexity that leaves value off the table.

European basketball is spread thin across domestic leagues, regional competitions, and inconsistent participation rules. Major global cities like London remain underrepresented, while iconic sports brands such as PSG and Manchester City don’t have teams.

From the NBA’s perspective, that’s a massive missed opportunity.

Rather than concentrating Europe’s biggest markets and brands into a single, premium product, the current system dilutes attention and commercial upside. The NBA has conviction that it has the political capital and resources to pull the most valuable brands under one centralized league, unlocking commercial scale that doesn’t exist today.

Second is fragmented media distribution.

Basketball rights are negotiated across 40+ major broadcasters, spanning 10-15 languages, each with different incentives and promotional strategies around basketball.

It’s almost impossible to standardize media distribution across these many players.

That’s why the EuroLeague outsourced a tedious global media and commercial sales process to IMG through the 2030-2031 season. While the league mustered ~$150M in commercial rights this year, it’s only a fraction of the NBAs ~$7B media business.

The NBA believes they leverage long-standing relationships with global streaming platforms like Amazon Prime, DAZN, or others to streamline their European media rights.

Third is underdeveloped infrastructure.

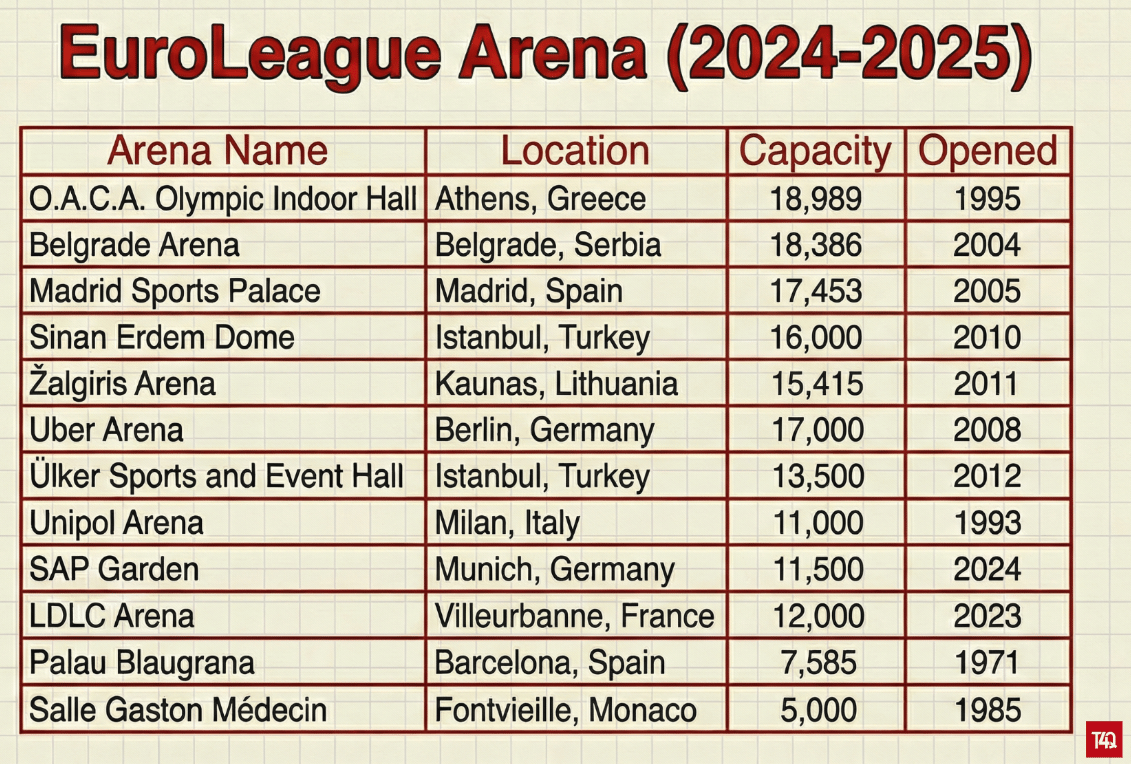

While the European basketball market is mature, its arena infrastructure is not.

Most EuroLeague venues are significantly outdated and under-commercialized - with limited seating capacity, few luxury suites, minimal premium hospitality, and little integration with surrounding mixed-use real estate. Many arenas seat 10K-15K fans, with some legacy venues far smaller.

The main constraint is financing.

In the U.S., governments frequently help subsidize stadium construction, contributing $4.3B in federal subsidies for 57 stadiums built between 2000-2020. In Europe, clubs largely rely on private capital, from institutional debt to wealthy benefactors (see with Juan Roig’s €400M investment in Valencia’s Roig Arena).

This infrastructure gap explains two things:

Why European clubs struggle to scale stadium revenues

Why the NBA is inviting private equity and institutional capital into NBA Europe while charging near $1B franchise fees

Franchises will need to invest a lot of money to build modern arenas and entertainment districts from the ground up.

When a shark smells blood in the water, it hunts.

And when an incumbent feels threatened, it has no choice but to protect its territory.

The Potential Legal Case (and Constraint) Against NBA Europe

Before we dive in, it’s important to clarify one thing: the EuroLeague is just issuing a warning. No legal action has been taken - and for good reason.

The EuroLeague keeps the door slightly open for collaboration. If there’s a scenario where it can access even a sliver of the economic upside that the NBA Europe could unlock, whether through commercial partnerships, shared distribution, or gameplay involving global brands, that flexibility is important.

But if relations continue to sour…

What legal case does the EuroLeague actually have?

Inducing Breach of Contract (Core Argument): EuroLeague’s strongest claim is that the NBA is improperly interfering with existing contractual relationships. The league has warned that the NBA has held discussions with EuroLeague clubs - including FC Barcelona, Real Madrid, ASVEL, and Fenerbahçe - all of whom are bound by long-term agreements and are shareholders in the EuroLeague itself. The role’s duality complicates matters and raises questions around contractual integrity.

NBA’s Rebuttal: A contract is a contract - and timing matters. At the time of reported discussions, these clubs were not bound to EuroLeague participation beyond the 2025-2026 season, ahead of NBA Europe’s targeted 2027 launch. Any breach would be the responsibility of the clubs, not the NBA, where exiting teams would simply trigger the agreed-upon $11.6M buyout clause.

Article 165 of the TFEU (The “European Sports Model”): This article emphasizes that European leagues are intended to promote “fairness and openness” in sport, language historically interpreted as support for promotion-and-relegation systems and open competitive pyramids. The court could raise legitimate questions regarding NBA Europe’s proposing 12 permanent franchises.

NBA’s Rebuttal: The inclusion of four rotating, non-permanent spots is likely the league’s saving grace. By creating a pathway for clubs from domestic leagues to qualify, the NBA can argue that NBA Europe preserves openness even though it borrows heavily from a franchise model.

1995 Bosman Ruling (Constraint, Not a Case): It established EU players as workers with full rights to free movement - a major constraint to NBA Europe’s operating model. A U.S.-style draft would be difficult to implement, forcing the league to rely on European youth academies and open recruiting. Salary caps would also present challenges under EU labor law. That being said, the EuroLeague itself recently introduced Competitive Balance Standards, including a luxury tax of up to €1 for every €1 exceeding base remuneration levels, proving financial controls can exist within EU constraints.

Where Do We Go From Here?

The NBA seems unfazed by EuroLeague’s warnings.

When asked about the threat of legal action, Commissioner Adam Silver was clear:

“If I thought that the ceiling was the existing EuroLeague and their fan interest, we wouldn’t be spending the kind of time and attention we are on this project… I think there is plenty of room for competition.”

Given the scale of the opportunity, the NBA is only going to double down.

But execution won’t be easy. FC Barcelona has already reaffirmed its commitment to the EuroLeague. Any club opting into NBA Europe will likely face billions in long-term infrastructure investment, from new arenas to mixed-use real estate, all with decades-long payback horizons.

More importantly, how will a more commercialized version of European basketball resonate with its most passionate fans.

The fun has just begun, and we’ll be dissecting every move.

Expect more from us on NBA Europe.

↓

LEAGUES & TEAMS

Photo: LIV Golf will sell stakes in its franchises for the first time.

LIV Golf seeks two ~$300M franchise sales to outside investors for the first time; LIV confirms return to New York in 2026 (Jan. 23rd, 28th)

Citigroup tapped to run the sale process; control/non-control stake options could sell as early as this year

NBA prepares to open data room for potential European league backers (Jan. 26th)

Expected to be opened to select private equity and strategic investors; includes RedBird Capital, CVC, Blackstone, and General Atlantic

Signals the NBA’s transition from exploratory discussions to a more formal capital-raising process for a potential European league [SBJ]

College Football Playoff keeps 12-team format for 2026 as expansion talks stall (Jan. 23rd)

Guarantees automatic bids to Power Four champions and a spot for Notre Dame if ranked in the top 12

Expansion to 16+ teams remains unresolved amid disagreement between the SEC and Big Ten, leaving ESPN’s $7.8B media deal under current format [AP]

↓

STARTUPS & VENTURE CAPITAL

Photo: Sports memorabilia authenticator The Realest raises $12M.

The Realest, a sports memorabilia authenticator, raises $12M in Growth funding (Jan. 28th)

Funds to expand league, player associations, and team deals; plans to grow e-commerce beyond high-end collectibles

Investment led by EnOne Ventures; other investors include Elysian Park Ventures, the PGA of America, and KB Partners, among others; follows a $4.4M Seed round in 2024 [SBJ]

CAA spins out Connect Ventures as a standalone VC firm, targeting early-stage sports, media, and wellness investments (Jan. 26th)

New fund will lead or co-lead Seed and Series A rounds, writing $5M-$15M checks for companies at the intersection of technology, commerce, and culture

Leadership includes former Lightspeed partner Nicole Quinn and CAA executive Michael Blank; early investments include TMRW Sports and Music.AI [Page Six Hollywood]

AO Ventures, AO & Tennis Australia’s VC arm, unveils its four startup investments from its ~$40M fund (Jan. 27th)

Investments include Bolt6, Raven Controls, Mindspring Padel, and Padel Haus, spanning AI-fueled officiating & broadcast, venue management, and Padel operators; fund targets 20 early-stage startup investments [AO]

↓

M&A AND INVESTMENTS

Photo: CVC’s Global Sports Group acquires Equine Network for $300M.

CVC’s Global Sport Group nears $300M acquisition of Equine Network, a US-based equestrian league (Jan. 26th)

Operates ~40 competitions across equestrian disciplines, encompassing more than 800 third-party–run events alongside media and data assets

Marks the first investment by CVC’s Global Sport Group, extending its strategy into niche sports with loyal audiences and recurring media and sponsorship revenues [SportsPro]

KKR nears a $3B deal to acquire a stake in CVC’s Global Sport Group (Jan. 29th)

Investment targets major sports assets, including Six Nations Rugby, WTA, and La Liga

KKR as front runner, other firms in the mix may include Ares Management, among others [PEInsights]

Professional Tennis Players Association (PTPA) reportedly seeks $1B to create a new commercial framework aimed at reforming pro tennis (Jan. 22nd)

Proposal outlines a three-tier global tour structure anchored by a “Pinnacle Tour”; features select elite events, consolidated media rights, and greater athlete pay

PTPA currently embroiled in ongoing legal action against the ATP, WTA, ITF, and Grand Slams, alleging “systemic abuse and anti-competitive practices” [SportsPro]

↓

Another Newsletter We Liked This Week: ENJOY Basketball

If you love hoops but hate the noise, you’ll love this. Enjoy Basketball, co-founded by Kenny Beecham, has partnered with NBC Sports on the network’s first creator-led NBA programming, bringing the fun back to basketball coverage.

No hot takes: just recaps, playoff storylines, NBA player interviews, and more. On the business side, The 4th Quarter has got you covered. But if you’re interested in staying up to date on what’s happening on the court, check Enjoy out!

↓

STRATEGIC VENTURES

Photo: X Games League partners with MoonPay and Stake as it debuts its new league this year.

[X Games] League announces four inaugural ‘X Games Clubs’; taps Stake as its official casino and sportsbook partner; partners with crypto payment infrastructure company MoonPay (Jan. 22nd-26th)

Four inaugural city-based teams from NY, LA, Sao Paulo, and Tokyo ahead of the league's Sacramento event; team owners to be disclosed soon

Real-time odds to be integrated into live broadcasts using Alt Sports Data; XGL events will also stream on Kick, a Stake-owned livestreaming platform

The Washington Post considers cutting its sports division amid mass layoffs, meanwhile California Post seeks to ramp up top LA sports hires (Jan. 26th)

Reportedly, hundreds of staff could be cut; sports desk at risk

WP pulled Olympic travel; won’t send reporters to 2026 Milan Cortina Games

↓

JOB BOARD

If cutoff & you’d like to see the entire list - click to view this newsletter in browser!