FEATURED STORY

Sports Rights Reshaped in Netflix vs. Paramount Battle for WBD

The news feed this week was unusually singular: Netflix and Paramount Skydance are in a high-stakes, $100B+ bidding war for the invaluable rights to Porky Pig and Yosemite Sam – yes, Looney Tunes characters.

And yes, Warner Bros. Discovery (WBD) really does own some of the greatest children’s TV franchises of all time.

Jokes aside, the battle for WBD will have seismic – and in many cases, cataclysmic – impacts on the future of Hollywood, streaming, news-media consolidation, and antitrust protections. You’ve probably heard every possible take on these fronts from every business podcast, news channel, and publication that exists.

So to stay on theme – and give you a breath of fresh air – we wanted to ask a question that no one else is asking:

How will this bidding war affect the sports industry?

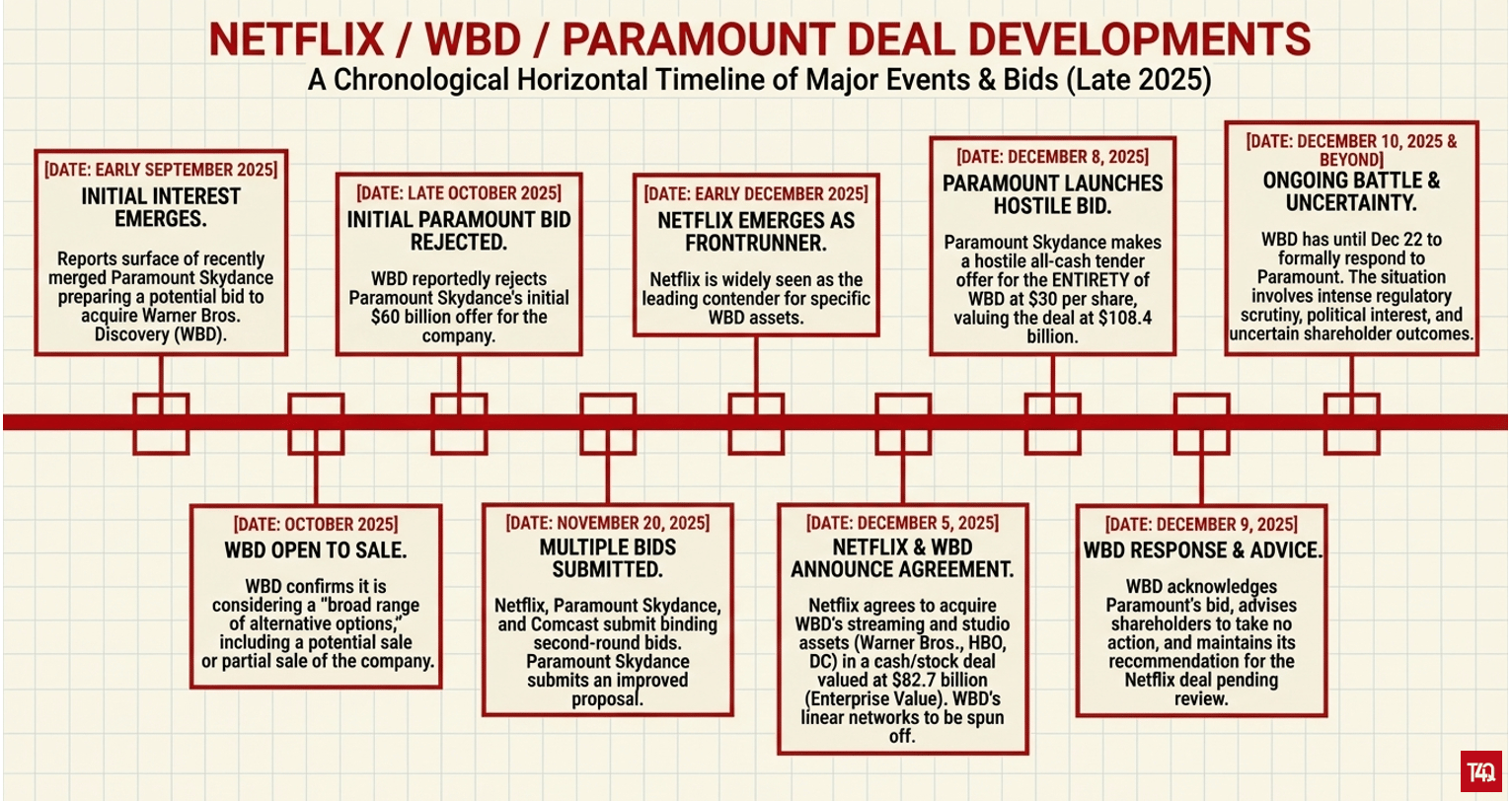

Everything That’s Happened With WBD

Here’s the only graphic you’ll have to read to catch you up to speed on all of the noise surrounding this deal:

So…Which Acquisition Scenario Is Best for Sports?

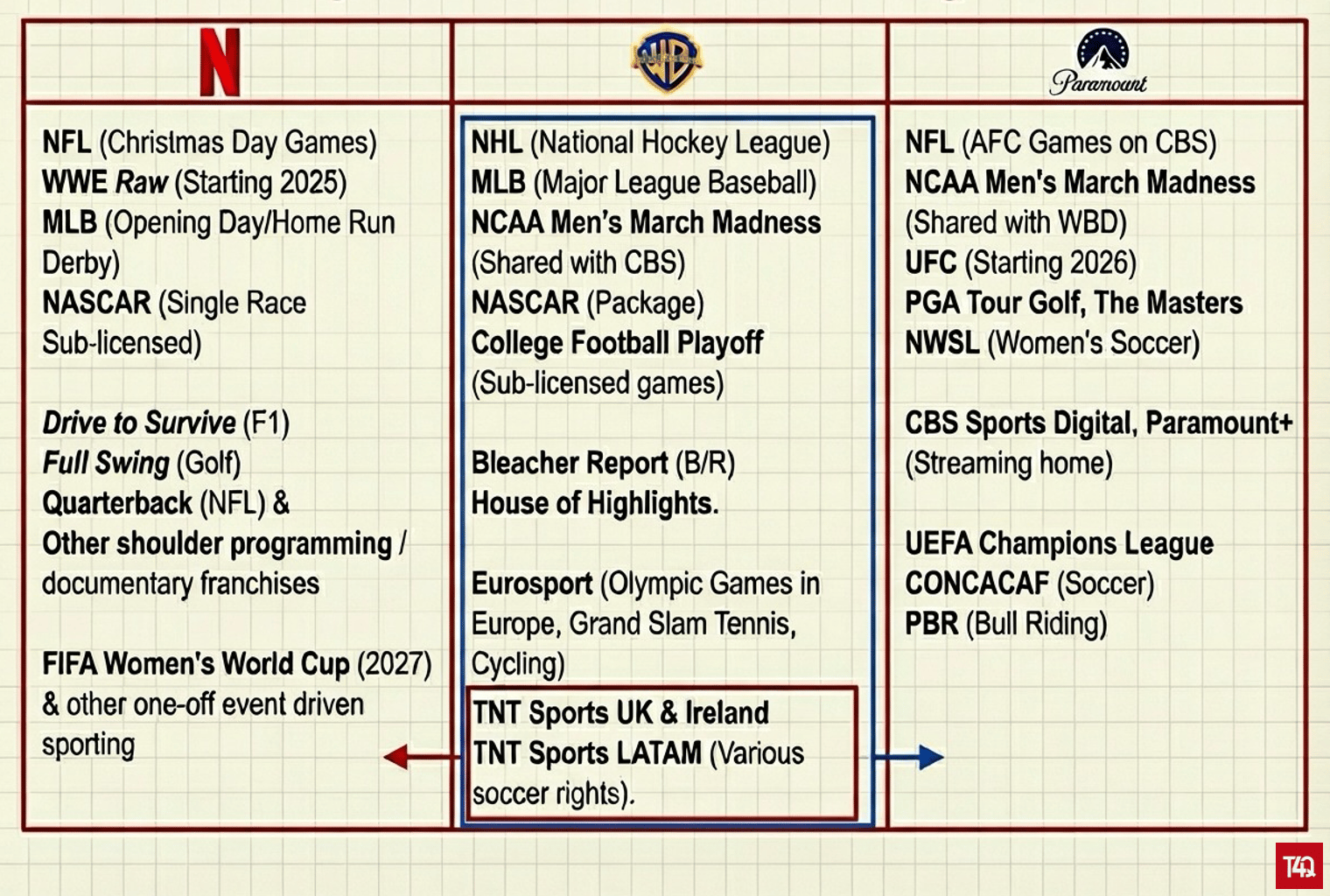

Each potential buyer affects the sports ecosystem differently - leagues, media-rights holders, distributors, and fans all feel the impact in distinct ways. To evaluate the scenarios, we need to understand which sports assets each bidder actually wants. Netflix and Paramount have very different motives, and these motives determine who wins and loses in each outcome.

Scenario 1: Netflix Takes Streaming

Netflix has made it clear that it has zero appetite for WBD’s legacy cable networks (CNN, TNT, TBS). Their DTC-first strategy is the opposite of a traditional linear bundle. Sports also wasn’t a core driver of the deal: Netflix voided the acquisition of TNT Sports U.S. and Eurosports. Co-CEO Ted Sarandos even reiterated to investors that the company’s long-standing sports strategy remains unchanged – focusing on “one-of-one” cultural moments (NFL Christmas, Jake Paul vs. Mike Tyson) rather than recurring rights.

But subtly, the high-growth assets that Netflix agreed to acquire include TNT Sports UK & Ireland and TNT Sports Latin America. Meaning that, unless they divest them, Netflix will own linear sports networks for the first in its 28 year history.

Coincidence? We don’t think so.

TNT Sports controls some of the most valuable and culturally important rights in both regions:

U.K & Ireland: Premier League, Rugby (Premiership Rugby; European club rugby rights), Cricket, UFC, Select WWE Events, and MotoGP

Latin America: Top football leagues (AFA – Argentina, FPF – Peru, ANFP – Chile), major European competitions (UEFA Champions League, Supercup)

Even though Netflix’s strategy doesn’t revolve around recurring sports programming, these markets give them a low-risk sandbox to test what integrating premium live sports into the Netflix platform could look like. Without spending billions on media rights for U.S. leagues, they can experiment with:

consumer appetite for live sports

packaging & pricing

whether rights drive engagement or profitability

whether a hybrid of “cultural moments + live rights” improves retention

This fits Netflix’s playbook. They routinely test major shifts internationally before bringing them to the U.S.:

Password-Sharing Crackdown: Piloted its “add an extra member” fee in Latin America before rolling out in Canada and Spain, and eventually the U.S. in 2023.

Mobile Gaming: Debuted early versions of “Netflix Games” in Poland in 2021 with two Stranger Things titles, then expanded the offering into the U.S. later that year.

So what happens to TNT Sports U.S.?

They’re left out of the deal entirely and stuck inside a highly levered, declining Global Networks division (expected to be >3x debt-to-EBITDA). Cash constrained, TNT Sports U.S. won’t be able to aggressively bid for future rights. The MLB and NHL both face major renewals in 2028 and may be forced to find new partners.

TNT Sports also loses HBO Max as its sister streaming outlet, hurting discoverability for its live games. Fans will now need yet another DTC app to watch key MLB and NHL matchups.

The biggest winner here: international leagues. The leagues emerge with a far stronger partner who can champion their content and experiment with ways to effectively distribute through its high-reaching platform.

Scenario 2: Paramount - The Colossus Play

This scenario is much simpler – WBD’s sports assets would consolidate under Paramount’s. In practice, CBS Sports likely absorbs TNT Sports, creating a colossal international sports broadcaster with rights spanning the NFL, NHL, MLB, NCAA, Big Ten, and UFC. The combined entity instantly becomes a “must-have” partner for leagues, backed by enough cash to comfortably handle rising rights fees.

This move could singlehandedly slow down cord-cutting, as CBS would hold a far stronger hand against streaming giants like Netflix & Amazon.

And unlike scenario 1, there are a few more winners here:

TNT Sports: CBS Sports stabilizes a declining business by giving TNT Sports deeper pockets and pairing it with an established DTC home in Paramount+

U.S. Leagues: They gain a financially secure, familiar broadcast partners they trust heading into future renewals

Consumers: Fans want fewer streaming apps. The Netflix deal – or a scenario where neither deal goes through – fractures the sports library even further by isolating TNT Sports U.S. A Paramount acquisition consolidates everything into Paramount+, while cable loyalists feel good knowing broadcast remains strong for another media rights cycle.

Is What’s Best For Sports, Best For Everyone?

While it’s clear that the sports world wins if Paramount gets this deal, there is one main concern that consumers are ringing the alarms on. This deal is bigger than sports. David Ellison, the CEO of Paramount Skydance said he also wants to combine CBS & CNN into a super news outlet that services “the 70% of Americans stuck in the middle.”

While end consumers will enjoy a nearly one-stop-shop for sports programming, it brings up a deeper debate. In addition to backboning this deal, Larry Ellison’s purchase of TikTok’s US operations means he now has a stake in a media platform with over 170M+ Americans on it. In this CNBC interview, David Ellison said “combining the #1 streaming platform [Netflix] with the #3 streaming platform [HBO Max] is anticompetitive.” If this deal goes through in Paramount’s favor, one might argue that a singular family wielding this much ownership across social media platforms, streaming, cable & linear, studios, might not be in the best interest for the masses.

Is media consolidation in linear programming a trend that will persist in the future as more people cut their cable cords and tune into DTC channels like social media & streaming? Will Paramount be the go-to exit in these types of scenarios?

Only time will tell.

↓

LEAGUES & TEAMS

Photo: NFL to launch a $32M men’s and women’s pro flag football league.

NFL to launch & financially back a new professional flag football league (Dec. 10)

NFL owners approved up to $32M (~$1M per team) to build men’s and women’s pro flag football ahead of the sport’s Olympics debut in 2028

Aligns with NFL’s global expansion strategy, positioning the league to own the sport’s infrastructure, talent pipeline, and future media rights [NBC]

Wrexham AFC secures minority stake investment from Apollo Sports Capital (Dec. 8th)

Apollo will fund the redevelopment of the STōK Cae Ras stadium, alongside a long-term club growth strategy to support the Wrexham Gateway Project

Deal follows June reports of a potential £375M+ ($475M) valuation and Apollo’s investment in Atlético de Madrid [Apollo]

Big 12 Conference, a collegiate athletic conference, announces partnership with the NFL in a strategic collaboration (Dec. 5th)

Partnership spans officiating, tech pilots, analytics, flag football, and global growth

B12 officials to access NFL clinics, training tapes, and pathways to pro advancement; deal expands NFL-flag footprint on campuses, links B12 to the league’s global strategy [Big12]

San Francisco 49ers sell stake for $90M+ in LP investment from OpenAI chair Bret Taylor, valuing the franchise at $9B+ (Dec. 8th)

OpenAI chair and Sierra co-founder Bret Taylor buys 1% stake, valuing 49ers at $9B+

Cap table includes Silicon Valley entrepreneurs Pete Briger Jr., Vinod Khosla, Byron Deeter, and Will Griffith; the York family retains ~90% control [SBJ]

Carolina Hurricanes (NHL) owner Tom Dundon explores a minority stake sale to fund his $4B+ Trail Blazers purchase (Dec. 3rd)

Talks center on selling an LP stake at a ~$2B valuation, among the highest in the NHL

Funds would support Dundon’s staged Blazers acquisition with partners including Cherng family & Marc Zahr [FOS]

Ice Cube’s Big3, a 3v3 basketball league, advances talks to license New York and Arizona expansion franchises (Dec. 3rd)

B3 taps Park Lane as advisor; enters due diligence stage with potential buyers

New teams expected to sell for $13M-$20M; aims for 12 teams by 2027 [Bloomberg]

SailGP, a high-speed sailing championship, is fielding three bids for a new €100M expansion franchise for its 14th slot (Dec. 3rd)

Abu Dhabi is reportedly leading the bid, with contesting China and Mexico bids

Team valuations now top $60M, insiders cite a €100M price for the team; move follows Swedish-based entry for the 13th slot [CityAM]

Prospector Baseball Group, a ‘modern, tech-driven MiLB collective’, acquires Jacksonville and Akron minor-league teams (Dec. 9th)

PBG buys Jacksonville Jumbo Shrimp (Triple-A) and Akron RubberDucks (Double-A) from Tampa Bay Rays CEO Ken Babby

Deal expands PBG to three clubs, following its acquisition of the Lancaster Stormers; group aims for ~15-team portfolio as MiLB consolidation accelerates [SBJ]

German Women's Bundesliga, ‘Frauen Bundesliga’ clubs, to form a new league body after breaking from the German Football Association (DFB) (Dec. 4th)

14 clubs reject DFB demands and will form the FBL e.V. on Dec. 10

Teams initially planned a €700M ($816M) investment; DFB pledged €100M over eight years for a joint venture; now, DFB involvement remains unlikely [TheAthletic]

↓

NEW FUNDS

Photo: APEX Capital launches a later-stage $350M growth fund for sports investments.

CAIS Advisors taps Eldridge and Arctos to co-manage a new diversified SME fund (Dec. 5th)

Fund to invest across the top 5 US leagues, media, and live events; portfolio to include 30+ sports franchises via primary, secondary, and co-investment vehicles

Minimum investment of ~$25K, with semiannual redemptions capped at 5% of NAV [CAIS]

APEX Capital, an athlete-backed VC firm, launches a later-stage €300M ($350M) growth fund for $10M-$50M sports investments (Dec. 10th)

New fund targets 10-20 cashflow-positive or near-positive sports investments

Stakes to range from 20%-49% for European and US companies; strategic minority stakes target governance upside

Adds to APEX portfolio, including Alpine F1, Baller League, and Bay Golf Club, among others [EUStartups]

Sports-tech VC fund Centre Court Capital closes its fund at ₹410Cr (~$45.5M) (Dec. 9th)

Fund surpasses its ~$40M target; firm to invest ~$900K-$2.5M in 15-18 startups across sports, fitness, wellness, esports, and gaming

Investment backed by Parth Jindal, Premji Invest, SIDBI, and SRI, among others [TimesofIndia]

↓

STARTUPS & VENTURE CAPITAL

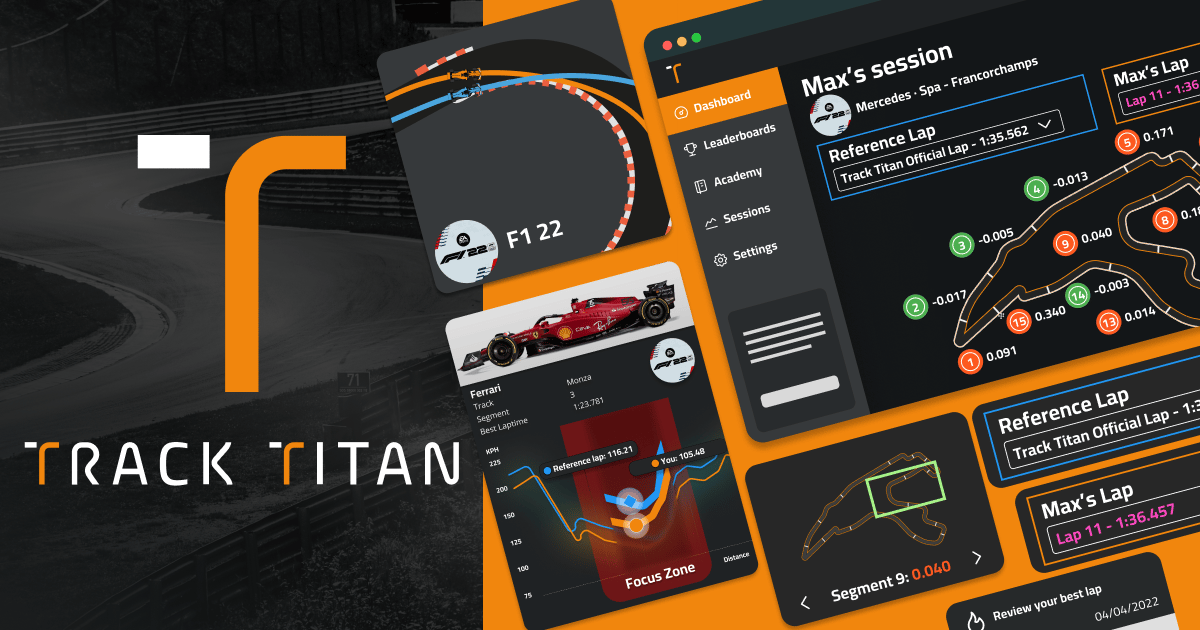

Photo: Track Titan, an AI-power coaching platform for motorsports, raises $5M in Seed funding.

Track Titan, an AI-powered coaching and community platform for sim racing/motorsport fans, raises $5M in Seed funding (Dec. 4th)

Funding will expand TT’s coaching platform to democratize pro-level racing insights

Investment led by Partech and Game Changers Ventures; other investors include APX, among others [Tech.eu]

GameChanger Analytics, a sensor-driven performance football wearable startup, raises $3.25M toward its $5M Seed round (Dec. 5th)

Launching with teams in January; full commercial rollout set for Q2 2026

System uses 12+ sensors, UWB anchors & AI haptics to track physical, technical, and tactical metrics; early users span Liga MX academies, MLS Next, and ECNL

Investment backed by angel investors [SBJ]

Arcturus, a 3D volumetric video platform for capturing real sports action, raises $2.3M in Seed funding (Dec. 4th)

Expanding 3D sports content solutions for broadcasters, teams, leagues, and venues

Investment led by LDV Capital; other investors include Myelin VC, Vanderbilt University, and angel investors from the Harvard Business School, among others [FinSMEs]

Outlier, a sports betting research platform, raises $10.7M in Series A funding (Dec. 4th)

Funds will expand product line, enhance predictive models, and grow its int’l subscriber base

Investment led by Discerning Capital; other investors include Tribeca Early Stage Partners and Next Coast Ventures, among others [Discerning]

Agilitas, an Indian high-performance sportswear startup, secures $4.4M investment from cricket star Virat Kohli after he reportedly turned down a $33.4M Puma extension (Dec. 10th)

Kohli moves his One8 sports and lifestyle brand under Agilitas ownership; startup aims to build India’s first global sportswear brand across footwear and apparel

Agilitas led by ex-Puma India MD Abhishek Ganguly; raised ~$70M+ in its first year from top VCs [SportsPro]

Logan Paul joins brother Jake Paul, Geoffrey Woo in an oversubscribed $30M close of ‘Anti Fund I’ (Dec. 10th)

Fund will invest in AI and robotics across pre-seed, seed, and growth stage startups; investments include OpenAI, Anduril, Ramp, Polymarket, and Cognition [StartupsMag]

↓

M&A

Photo: Otro Capital acquires a minority stake in University of Utah Athletics Holding Company.

Netflix agrees to buy Warner Bros Discovery’s studio and streaming assets for $82.7B; Paramount Skydance launches a $108.4B hostile bid (Dec. 5th, 8th)

WBD shareholders to receive $27.75/share in cash + Netflix stock

Netflix’s largest deal would add HBO, WB studios, and 128M subs to its 300M+ global base; WBD to split into two public companies with sports assets under new Discovery Global

Paramount bid includes $30/share all-cash; $24B in debt financing from Saudi Arabia, Qatar, and Abu Dhabi wealth funds alongside Jared Kushner’s Affinity Partners [HollywoodReporter] [HollywoodReporter]

University of Utah, to receive PE investment from Otro Capital via ‘Utah Brands & Entertainment’ (Dec. 9th)

Otro Capital joins as a minority investor, focused on maximizing revenue-generation, ticketing & concessions, sponsorships, and licensing

First-known PE stake in a university athletics holding company; modeled after Clemson, Kentucky holdco structures [FOS]

Disney enters a three-year IP licensing agreement with OpenAI via Sora and takes a ~$1B equity stake (Dec. 11th)

Fans will draw on 200+ characters across Disney, Marvel, and Pixar, among others

Disney to become a major OpenAI customer; will receive warrants for additional equity opportunity [OpenAI]

KKR reportedly enters ‘advanced talks’ to acquire a majority stake in Arctos Partners for its sports assets (Dec. 5th)

Arctos manages ~$7B in sports assets, holding stakes in 20+ franchises across the five major US leagues; only PE firm approved to invest across the NFL, NBA, MLB, NHL, and MLS [Bloomberg]

Saudi PIF unveils its 93.4% majority stake of Electronic Arts in its $55B LBO (Dec. 3rd)

Deal funded with $36.4B equity and $20B debt; EA shareholders vote later this month

Announced in September, recent filings reveal PIF’s stake at 93.4%, Silver Lake’s at 5.5% and Affinity Partners' at 1.1%; Saudi PIF to contribute ~$29B in new cash [SBJ]

Perplexity AI partners with and receives investment backing from Cristiano Ronaldo (Dec. 5th)

Deal includes a global sponsorship deal and launch of an internal Ronaldo fan hub

Perplexity aims to expand enterprise tools, paid tiers, and international reach amid AI-search surge [Bloomberg]

French football star Paul Pogba invests in Al Haboob, a modern Saudi camel racing team (Dec. 10th)

Pogba takes minority stake in the first global, modern camel racing team; team will compete across the UAE and the Gulf [ESPN]

↓

STRATEGIC VENTURES

Photo: Fanatics CEO Michael Rubin discussing Fanatics new prediction markets weeks before official launch.

Fanatics partners with Crypto.com and launches prediction ‘Fanatics Market’ (Dec. 3rd)

Prediction market officially launches in 24 states under commodities regulation

Markets and prices offered by Crypto.com; follows Fanatic’s July purchase of Paragon Global Markets [Fanatics]

Dream11, an India-based fantasy-sports unicorn, pivots into a Twitch-style sports entertainment platform in the wake of India’s RMG ban (Dec. 4th)

Shift driven by India’s real-money gaming ban, which erased 95% of revenue & all profits

New creator-led watch-along product targets ~1B global users; monetization via ads + creator revenue share

Dream to split into 8 standalone units, including fintech, streaming, AI, travel, and gaming [EconomicTimes]

Gary Lineker’s Goalhanger, a football podcast producer, partners with Netflix for 2026 World Cup coverage (Dec. 3rd)

Netflix to film daily Rest Is Football episodes in NYC with Lineker, Alan Shearer, and Micah Richards

Goalhanger previously worked with DAZN; move follows Netflix distribution deal to host Spotify-The Ringer sports podcasts [SportsPro]

US Ski & Snowboard, a US winter NGB, partners with YouTube for creator-led Olympic content ahead of the 2026 Milano Cortina Winter Olympics (Dec. 8th)

YouTube to embed creators at key World Cup events ahead of Milano Cortina ‘26; collaboration delivers BTS athlete access and boosts NGB’s youth reach

YouTube to train athletes on storytelling and channel growth to expand personal brands [USS&SB]

NBCUniversal returns with its Creator Collective campaign for the 2026 Winter Olympics (Dec. 3rd)

25+ creators from YouTube, Meta, and TikTok will travel to Milan-Cortina, gaining access to athletes, events, and even the athlete village for content

Paris 2024’s collective drove ~300M views and 6.55B NBC Sports social impressions [SBJ]

Polymarket re-enters the US market after its four-year 2022 ban (Dec. 3rd)

App reopens to a 200K+ waitlist after its 2022 CFTC settlement barred US activity; launch begins with sports event contracts, with ‘markets on everything’ to follow

Follows NYSE operator ICE’s pledge to invest up to $2B [FOS]

CNBC enters exclusive multi-year deal partnership with Kalshi to integrate prediction-market data (Dec. 4th)

Kalshi’s real-time event probabilities enter CNBC TV, digital, and subscription products, beginning in 2026

Includes on-air Kalshi ticker and CNBC-curated markets page launching on Kalshi’s platform [CNBC]

Owl AI, an AI sports officiating and analysis platform, partners with Major League Pickleball for 2026 season (Dec. 4th)

MLP will deploy Owl AI’s auto line-calling and challenge system at 2026 events

Partnership follows MLP’s breakout 2025 season: attendance +52%, ticket revenue +94%, and social media impressions +400% [MLP]

↓

JOB BOARD

If cutoff & you’d like to see the entire list - click to view this newsletter in browser!