FEATURED STORY

Inside the Bidding War for Sports’ Most Valuable Lawyers

The best sports lawyers should now be compared to AI researchers.

Let us explain.

Wall Street’s elite law firms are locked in an aggressive bidding war to court the ultra-scarce supply of sports lawyers as they scramble to spin up their own sports law practices. Why? Higher deal velocity, deeper institutional connections, and surging team & league valuations means higher transaction volume – and higher legal fees.

They’re reportedly floating $15M+ annual salaries to get the job done. Here are the major moves so far, with more on the way:

September 2025: Frank Saviano – top corporate sports lawyer (former Proskauer & Rose) – leaves Latham & Watkins to join Kirkland & Ellis

October 2025: Jason Krochak leaves Proskauer & Rose to join Frank at Kirkland & Ellis

November 2025: Jon Oram – industry leading sports lawyer at Proskauer & Rose – left to Davis Polk to launch its subsidiary sports practice

[Yes, most of these lawyers have worked at Proskauer. We’ll get to that in a second.]

As frenzied as this looks, it shouldn’t surprise anyone. We’ve seen the exact same dynamic in AI when Meta offered $100M+ a year to poach the world’s best AI researchers. The economics made sense - AGI is a quadrillion-dollar goldmine, and elite researchers are scarce. Swap AGI with sports dealmaking and researchers with lawyers, and the analogy is almost perfect.

But while the situations are similar, the sports lawyer bidding war unravels interesting power dynamics in the sports law industry:

Why there are so few lawyers – reportedly as low as seven – that control almost all major sports dealmaking

How elite Wall Street law firms fell behind

How firms will position themselves to win deal flow in this new era of sports transactions

Let’s get into it.

How a Few Firms Got So Ahead

Half a century ago, sports law rarely piqued the interest of major Wall Street law firms. Franchise revenues resembled those of local department stores, leagues’ antitrust immunity (thanks to the 1922 Federal Baseball Club v. National League decision) meant little money in litigating against leagues, and deal flow was a fraction of what it is today.

The door was wide open to become the league’s de facto outside counsel:

Willkie Farr & Gallagher became the MLB’s preeminent legal advisor in the 1930’s – defending its antitrust exemption in Flood v. Kuhn and leading the Pete Rose gambling investigation (which led to his lifetime ban of baseball).

Covington & Burling became the NFL’s legal backbone, drafting and lobbying for the Sports Broadcasting Act in 1961, which allowed the league to pool media rights.

Proskauer & Rose modernized the NBA beginning in the 60’s – facilitating the merger between the NBA & ABA and drafting expansion agreements for new franchises.

Expertise quickly consolidated. As these leagues grew, they leaned on a small group of legal partners who essentially engineered the underlying rules of the modern sports economy – league governance, CBA structures, ownership diligence, media-rights architecture, team expansion frameworks, etc.

A revolving door soon emerged between these firms and leagues offices: Bowie Kuhn (MLB), Paul Tagliabue (NFL), and David Stern (NBA) all went from partner to commissioner. These “trees” helped law firms build a tight, defensible moat around sports-specific legal work.

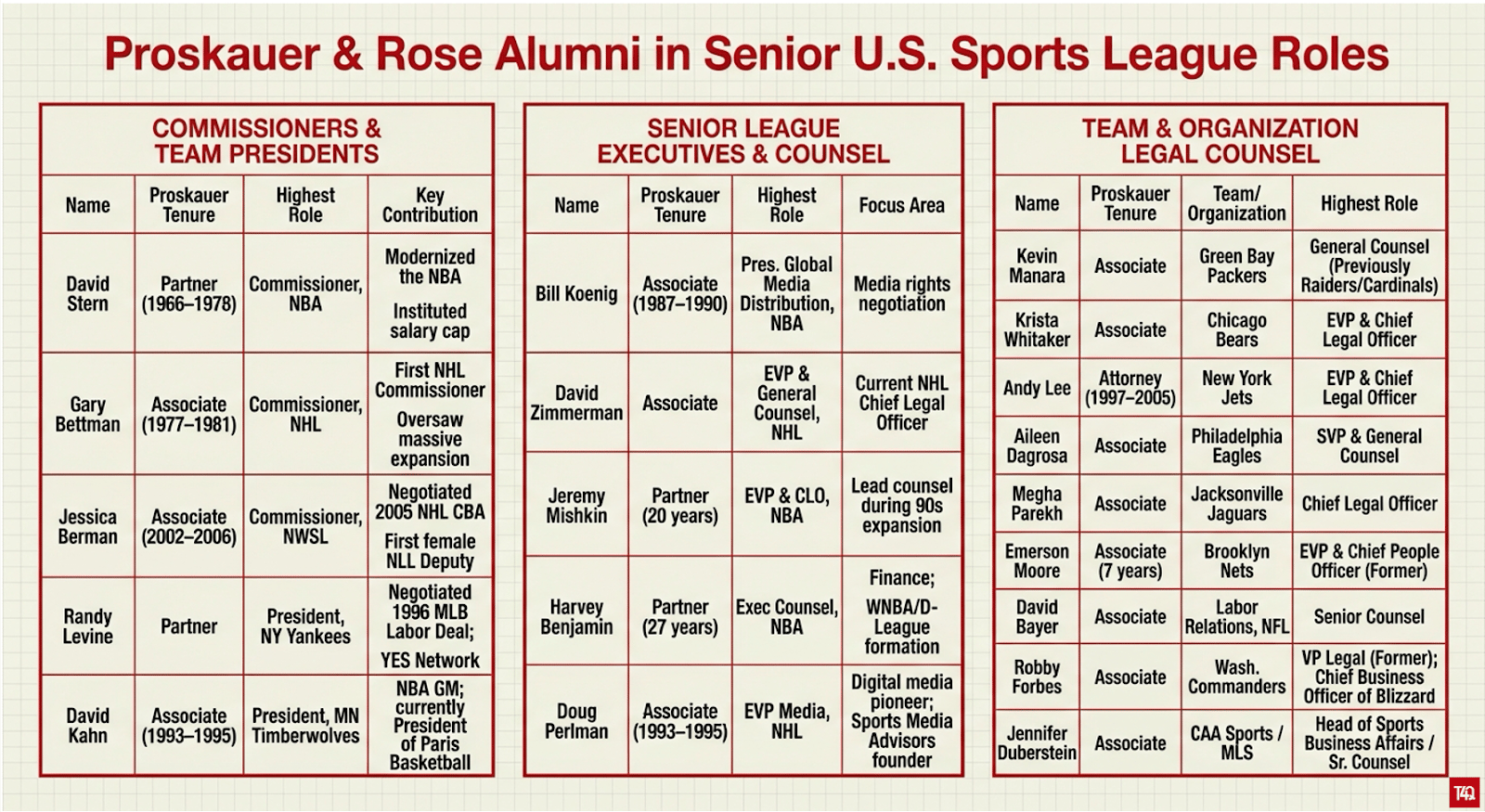

Just look at Proskauer & Rose – their lawyer tree resembles the Bill Walsh coaching tree in the NFL (yes, even Mike Tomlin and Andy Reid came from it):

But the faucet is starting to leak. The major Wall Street firms have caught onto the lucrativeness of advising on sports transactions and have begun aggressively poaching Proskauer’s top talent.

Juggernauts like Latham & Watkins, Kirkland & Ellis, and Davis Polk are expanding into their territory. Paul, Weiss formally launched its sports practice this October and was named the official law firm for the New York-New Jersey World Cup 2026 Hosting Committee.

Still, Proskauer leadership isn’t worried. Chairman Joe Leccese put it this way:

“It will only strengthen our position because we continue to have the largest and deepest team across all the verticals one needs to support the industry, and we enjoy the broadest and most diverse client base. As a result, we have more deals and more cases, which further expands our experience and expertise advantage. Ultimately, what matters is not what lawyers do, but what clients do.”

So how does each law firm stack against each other in the arena?

Sports Law’s Competitive Landscape: Wall Street vs. Incumbents

Each elite Wall Street law firm has its own distinct angle in the sports market. While there are many horses in the race, we’ll focus on the most recent movers:

Kirkland & Ellis LLP – Private Equity’s One Stop Shop

Kirkland’s approach is straightforward: cross-sell sports deals to their enormous client base of alternative asset managers – currently generates the largest deal flow for PE of any firm – who have a growing appetite for the asset class.

Hiring Jason Krochak & Frank Savino fits the strategy perfectly. Jason brings prolific deal experience on private equity deals in sports, including guiding the Bills ownership through their minority sale to Arctos Partners, a Kirkland client. Frank helped Silver Lake’s portfolio company, Diamond Baseball Holdings, roll up 40+ minor league baseball teams.

Kirkland can now act as a full-service platform for investors, minimizing leakage to sports-focused firms. And because private equity firms write the biggest checks, Kirkland stands to earn the biggest fees.

Paul, Weiss, Rifkind, Wharton, & Garrison LLP – Navigating Complexity

Sports is uniquely complex: bespoke equity structures, strategic partnerships, layered relationships between leagues, teams, and players.

Paul, Weiss has a long history of navigating litigation complexity:

Defended the NFL in concussion settlements

Represented the league in Brian Flores’s discrimination lawsuit

Served as FIFA’s outside counsel in litigation and arbitration

Advised Northwestern during investigations into athletic-program misconduct

In tough situations, Paul, Weiss is the shield.

For complex transactions and investment vehicles – they also act as the sword, advising on:

WWE and Endeavor forming TKO Group

Apollo launching Apollo Sports Capital

Formation of Los Angeles Golf Club for TGL

Jim Ratcliffe’s vehicle Trawlers Limited for his 25% stake in Manchester United

With a dedicated sports practice now in place, Paul, Weiss is positioning itself as the firm that helps clients navigate the most complex legal and finance structures in modern sports.

Davis Polk – The New Sports M&A Kingpin?

Jon Oram spent years as Proskauer’s go-to advisor on sports M&A – franchise sales, structured finance, joint ventures, and facility development. Now he’s building Davis Polk’s sports practice from the ground up.

Davis Polk already has deep relationships with Wall Street’s top M&A banks, advising on some of the largest M&A transactions across industries. In fact, the firm advised Josh Harris in the $6B Washington Commanders sale – a record sale price for a franchise at the time. But even in that deal, Harris hired Hogan Lovells to tap Matt Eisler’s sports expertise.

Having Oram in-house gives Davis Polk a true lead partner who can quarterback the largest transactions without needing external expertise.

Proskauer & Rose and the Incumbents – They’ll Be Just Fine

What about the incumbents? Given the recent loss of marquee talent, we’ll focus on Proskauer:

They face three main challenges:

“The Academy” Problem: They develop the best sports lawyers in the industry, which makes them vulnerable to rival firms poaching their top performers.

General Counsel Trap: Many departing partners owned high-value litigation and transactional work. If that deal flow migrates to Wall Street firms, Proskauer risks being relegated to lower-fee general counsel work.

Compensation Ceiling: Proskauer can’t match the financial firepower of Kirkland or Davis Polk without destabilizing its partnership – a concern amplified if substantive fees walk out the door.

These concerns are real, yet Proskauer is still a horse worth betting on.

They’ve specialized in a sector poised to pay out 100x as deal velocity accelerates. They maintain the deepest relationships across league offices and team leadership. Joe Leccese, Chairman Emeritus, remains one of the most powerful figures in sports law, with decades spent writing bylaws and resolving league crises. And the sports landscape is extraordinarily multifaceted: corporate transactions, real estate and facilities, labor and employment, antitrust, media rights, intellectual property. The incumbents are still the only firms truly specialized across all dimensions.

We’ll see how this race unfolds. Wall Street has the capital to build a dominant foothold. But if Proskauer keeps its network intact and its “bag” deep enough, they’ll have no trouble maintaining the deal flow to stay ahead.

↓

LEAGUES & TEAMS

Photo: WOW FC raises capital from Cristiano Ronaldo and UFC superstar Ilia Topuria.

WOW FC, a Spain-based MMA promotion, adds Cristiano Ronaldo as a shareholder to drive growth across Europe, LATAM, and the Middle East (Nov. 27th)

Ronaldo joins UFC star Ilia Topuria as equity partner to drive WOW’s global expansion

WOW events up 400% YoY, drawing 5K+ fans, airing in 170+ countries [Sportaran]

LaLiga secures €5.25B ($6.08B) in domestic media rights deals with DAZN and Telefonica’s Movistar+ until 2032 (Nov. 28th)

New cycle lifts annual media revenue above €1B (~$1.16B) for the first time

Telefónica & DAZN retain rights, splitting five games per matchday each; BBC Sport joins as a highlight clips partner [Onefootball]

Cricket Australia, the country’s cricket governing body, speculates $394M–$523M from Big Bash League (BBL) team stake sales (Dec. 1st)

Plan may include 49% stake sales in six clubs and full sale of two marquee teams

Up to $263M earmarked to repair CA’s budget and grassroots cricket reinvestment; $66M to boost BBL player salaries and marketing [SportsPro]

Grand Slam Track offers creditors a 50% repayment offer amid bankruptcy fears (Nov. 28th)

Among vendors, World Athletics rejected the repayment proposal (owed £30K or ~$40K)

World Athletics reportedly advises GST to pay back athletes first from the $10M+ due to athletes and vendors [SportsPro]

DAZN proposes giving Italian football league Serie A an equity stake to deepen their partnership (Dec. 2nd)

Move would build on NFL-ESPN deal, tying media control to equity ownership

DAZN targets $5B revenue in 2025 following Foxtel acquisition and PIF minority investment [CalcioeFinanza]

COH Sports, Sheffield United’s ownership group, seeks capital via a minority stake sale of up to 20% (Nov. 28th)

Group explores new investors after early struggles post-Dec-2024 takeover

Talks include restructuring repayment terms amid poor standings, missed Premier League promotion, manager turnover, and underperforming signings [Bloomberg]

England’s Women's Super League reportedly receives an investment proposal amid its strategic overhaul (Nov. 27th)

WSL delays review of the offer pending a league-wide overhaul; clubs told bids may resume after formal advisers are appointed

Follows Goldman/Deloitte partnerships to explore long-term league growth and revenue options [PEInsights]

NY Jets, Eastern College Athletic Conference commit $1M to launch a 7-on-7 collegiate women’s flag league, starting in 2026 (Dec. 2nd)

$1M fund provides grants for schools; season runs Feb–Apr with playoffs at Jets HQ in 2026, MetLife thereafter

League to debut with 10 teams, targeting 20+ schools within four years [NFL]

European American football leagues ELF & EFA rejoin under a single governance, following EFA teams' exits (Nov. 27th)

EFA breakaway teams return after pushing back ELF transparency and governance; new BoG to jointly oversee operations, commercial, and media rights

Governance structure outlined by co-CEO Ingo Schiller, 885 Capital, Oakvale Capital, D2D4, and Gandler Sports Group [SportsPro]

Former Newcastle Utd owner Mike Ashley bids £20M to acquire Sheffield Wednesday as administrators seek a preferred bidder (Nov. 26th)

Bidders must show £50m proof of funds to enter due diligence

2 US consortiums also in the mix as Wednesday faces financial distress; rival club Sheffield United expresses interest in merging with Wednesday [Telegraph]

↓

M&A

Photo: Anta Sports is exploring a multibillion dollar takeover of Puma.

Anta Sports, a Chinese sports apparel company, is exploring a potential multibillion-euro takeover bid for Puma (Nov. 27th)

Anta weighs bid, possibly teaming up with sportswear rival Li Ning and PE firms to acquire stake; Puma stock price is down ~50% from the beginning of the year [Reuters]

Netflix, Comcast, and Paramount step up bids for Warner Bros. Discovery’s second round (Dec. 2nd)

Netflix submits its second, mostly cash offer, ‘securing tens of billions in financing’ for WBD’s streaming and entertainment assets

Paramount and Comcast also issued improved second bids for WBD’s assets; Paramount targets WBD wholly, while Comcast targets entertainment assets [WSJ]

Live Nation announces partnership with and equity stake acquisition in non-alcoholic functional seltzer brand Hiyo (Dec. 1st)

Deal brings Hiyo’s social tonics to select LN’s venues, fueling Hiyo’s national expansion

Hiyo joins Liquid Death, Owen’s Craft Mixers, and Jolene Coffee in LN’s growing consumer brand portfolio [LiveNation]

Dozens of potential buyers reportedly line up for Charter Communications’ Spectrum SportsNet acquisition (Dec. 2nd)

Interest from PE to major media; Charter seeks single buyer for Dodgers & Lakers RSNs

Lakers & Dodgers owner Mark Walter seen as ‘logical acquirer’ after $10B Lakers acquisition; Charter subsidy will likely ‘cover 12 years of projected RSN losses’ [SBJ]

↓

STRATEGIC VENTURES

Photo: DraftKings is officially the exclusive Sportsbook and Odds Provider of ESPN.

ESPN, DraftKings kick off their official sportsbook partnership following the ESPN-PENN deal’s early fallout (Dec. 2nd)

DraftKings odds now integrated across ESPN broadcasts/app with exclusive parlays;

PENN paid $1.5B + $500M in warrants for ESPN Bet rights but exited after 2 years; ESPN Bet Live halted to reevaluate betting programming [SBCAmericas]

Metropolitan Park, a Steve Cohen & Hard Rock–backed casino venture, secures a key license recommendation for its $8B project (Dec. 1st)

NYS Gaming Commission facility board unanimously backs the venture next to Citi Field; each bidder would owe $500M in license fees plus $500M in capital upgrades

Move would add a hotel, casino, 25-acre green space, and a 5K-seat venue by 2030; project awaits a final approval decision via the entire gaming commission [FOS]

Genius Sports, FanDuel Sports Network partner to launch an ‘Intelligent Content Platform’ for NBA/WNBA broadcasts (Dec. 2nd)

First nationwide rollout of GeniusIQ metrics: shot probability, heat maps, and defender distance; new on-screen assets to become sponsorable inventory across 15 RSNs [Genius]

Montierre Development, an experimental youth sports developer, to begin $1B mixed-use S&E project ‘The Dynasty’ (Dec. 1st)

1.1K hotel rooms, 17 sports fields, and 500K sq ft of retail/restaurant space at the Ocoee-Apopka corridor anchor the development

Partners include AECOM, Innovated Studios & Finfrock [ConnectCRE]

Dentsu, a Japan-based marketing company with sports-sector expertise, partners with basketball’s East Asia Super League in a long-term strategic alliance (Dec. 2nd)

Targets Asian basketball’s APAC reach, beginning with Taiwan and the Philippines

Leverages Dentsu’s sports-marketing network to drive fan engagement and brand growth, elevating clubs, athletes, and FIBA-backed competitions [Dentsu]

Leyton Orient, a third-tier English club, taps architectural design firm Populous for a new stadium and multi-sport campus (Nov. 28th)

Project includes public hub, multi-sport facilities, retail, leisure, and ELF integration via London American Football team

Populous’ track record includes Tottenham Hotspur Stadium, Wembley, The Sphere, among others [LeytonOrient]

↓

JOB BOARD

If cutoff & you’d like to see the entire list - click to view this newsletter in browser!