FEATURED STORY

State of The Union on The Collectibles Industry

In the past 20 years, Pokémon cards appreciated by 3,261%. Looking only two years back, these pieces of cardboard rose nearly 50%, outpacing the S&P 500’s typical 12% annual return. Who would’ve thought that Pokémon cards our moms threw away are now worth enough to finance a startup’s pre-seed round!

Just three months ago, a former Blackstone exec got backed by the leading auction house, Christie’s, and launched a luxury handbag hedge fund solely investing in Hermès Birkin and Kelly bags - which realized a 34% net ROI within a 43-day average resale timeline.

While most investors are continuing to chase the shiny object in AI, we believe the overlooked alpha lies in understanding the nostalgic consumption habits of “Kidults.” And even though the highest-dollar end in collectibles is still supported by older, wealthier cohorts, Gen Z and Millennials are the demand engine for a lot of today’s collectibles velocity. These are the same demographics that fell in love with popular IP like Marvel Comics & vintage Super Mario video games that are now sitting on roughly $23T of spending power. They have the money… it now makes sense why they’d buy things that quench their inner nostalgia and make them feel like a kid again.

This phenomenon that’s been happening is too fascinating not to research, so we created your introductory State of the Union on the Collectibles Industry. After reading this, you’ll go from 0 → knowing the bleeding edge trends & behaviors that are shaping this space.

Before we dive in, it’s important for you to know the entire landscape of key players. Instead of reading a paragraph, reference this all-encompassing graphic we cooked up:

“Collectibles” can also be a bit of an ambiguous term.

There are millions of objects society chooses to collect. For clarity, here are the categories we’ve been tracking most closely:

Sports trading cards and sports memorabilia (jerseys, ticket stubs, etc.)

Pokémon / TCG

Sneakers

Handbags

Wine & Spirits

Watches (incl. Independent watch makers)

Fossils & artifacts

Art

Historical documents

First-gen tech (e.g., sealed first-gen iPhone now worth $100K+ because no one kept them sealed)

Each are different categories, different buyer bases, and different liquidity profiles.

But when did objects like plastic cards become so damn investable?

What’s Driving The Macro Tailwinds That Institutionalized Collectibles

The collectibles market didn’t explode overnight. It was pulled forward by a series of macro tailwinds that really awakened post-pandemic.

During COVID, millions were stuck at home: cash-rich, experience-poor, and searching for something to keep them sane.

Trapped in childhood homes while the world felt uncertain, many gravitated toward nostalgia - immersing themselves in old hobbies like collecting that reminded them of simpler times.

Grown adults rummaged through basements to rediscover long-forgotten collections. Influencers were live ripping packs in front of hundreds of thousands of viewers hunting ultra-rare pulls. At the same time, speculators with an itch to make money flooded the market.

The result was an explosion in market activity:

High-volume auctions: Goldin auction house sales surged from $28M in 2019 to $100M in 2020

eBay trading volume: Domestic trading card sales rose 142% in 2020, with over 4M+ cards sold than the prior year

Infrastructure backlogs: By early 2021, PSA was receiving 500K+ cards per week, leading a backlog of 12M+ items

But what made collectibles so unique of an asset was that they were perceived as inflation hedges. Which makes sense given that they’re intrinsically scarce due to structurally constrained supply.

In fact, when equities corrected sharply in 2022 amid rising rates and inflation, collectibles proved to be quite resilient.

More importantly, we’re expecting the “largest intergenerational wealth transfer in history”. Over the next decade, $31 trillion will move to younger generations, with roughly $1T allocated to art and collectibles. High-net-worth collectors allocate around 20% of their wealth to collections; for Gen Z, that number jumps to 26%.

This asset class isn’t going anywhere anytime soon.

The One Formula That’s Turning A Hobby Into A Liquidity System

content → entertainment → gamification → transaction → liquidity → repeat

The surge of nostalgic interest around collectibles is not accidental. Content is king; and it starts here.

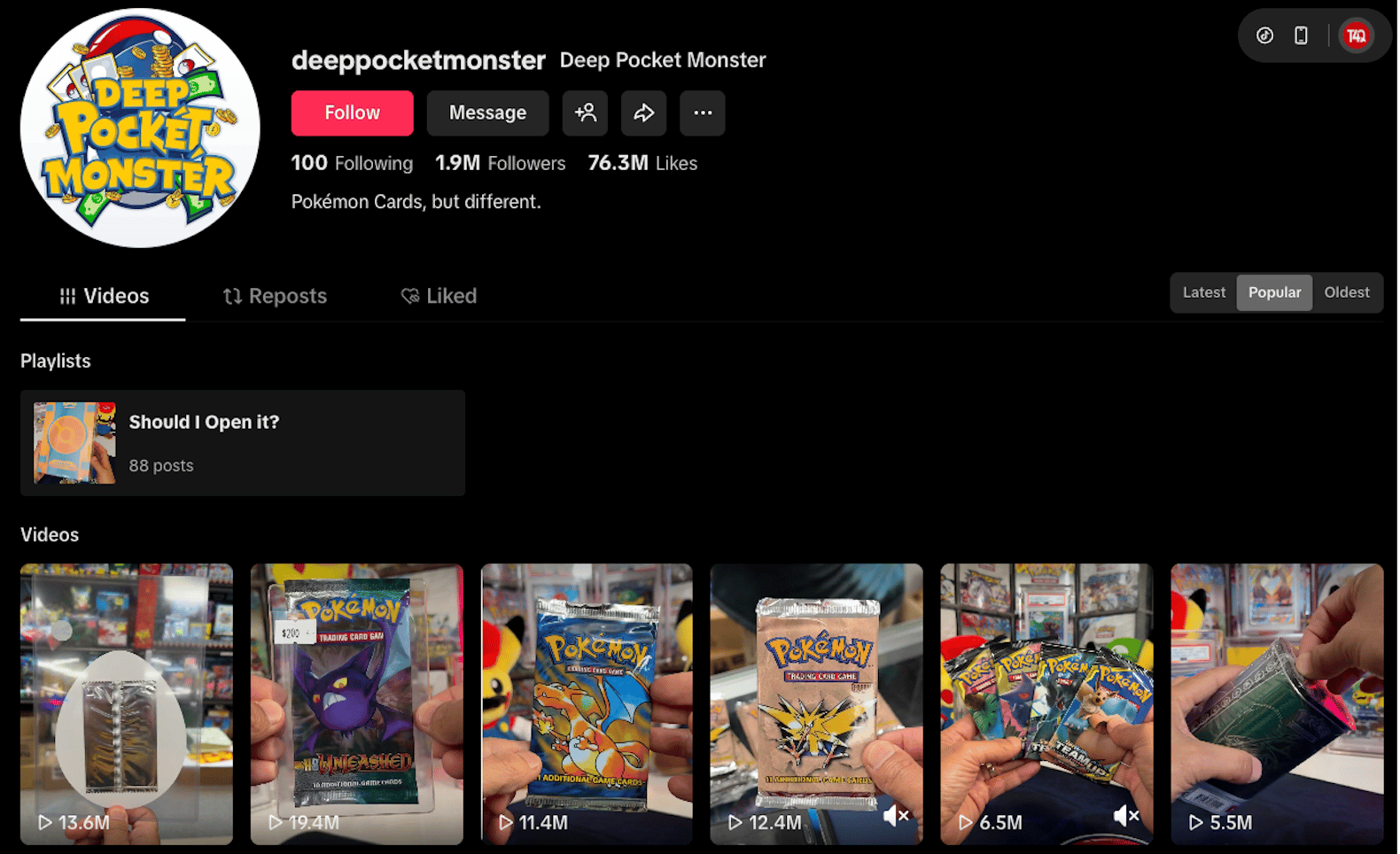

Look at DeepPocketMonster, a content creator who’s amassed 4M followers and nearly ~100M likes across platforms just by buying rare card packs and opening them for his viewers. His engagement numbers, average video watch time, and viewer retention is through the roof as his community waits for him to pull a ‘chase’ card (a rare, highly-desirable card that collectors seek).

He’s even transcended the online Pokémon enthusiast niche, and got invited to do a pack opening on Ford Field with the Detroit Lions (topped it all off by pulling a $3K card).

Creators alongside DeepPocketMonster like AlexKetchem and backyardbreaks are using entertaining content to blast casual sideline folks off their couches and into trading card shows and stores in hopes of finding their own collectors gems.

Now here’s where it gets interesting.

The Digital “Pack-Ripping” Phenomenon

Trading cards and “cheaper” collectibles are now the growth engine of this space. They are a lower financial barrier of entry than procuring a coveted collector’s watch like the $31M Patek Philippe Grandmaster Chime.

To lower the barrier of entry to practically $0, Pokémon launched a freemium mobile trading card collecting game that took the world by storm. Pokémon TCG Pocket hit the app store on October 30, 2024 where users could rip open virtual packs, chase for a hit, and showcase it to other users on the platform. Everything like the real life collectible…but without the physical cards.

In its first year, the mobile app earned a record $1.25B. $1.25B…with a B…in its first year.

18B booster packs opened

111.7B cards collected

96M trades conducted

12B battles held

6B likes sent

150M app downloads

Supposedly, Pocket players collected 10x more cards than the physical Pokémon TCG Cards even printed in its best year.

This gamification of collecting, in addition to the live streaming on Whatnot & Fanatics Live, has spurred the launch of the digital “pack-ripping” phenomenon. Platforms like GameStop’s Power Packs, Courtyard, Arena Club, Boxed.gg, ClutchPacks, Packz, and Phygitals have created ‘pay-to-rip’ digital experiences where users pay to open a pack digitally, are entitled to get the physical card shipped to them, or have the option to sell it back to the platform for 90% of the item’s value.

This digitization of collecting has even manifested into unique IRL experiences like Pokémon Card vending machines in grocery stores.

Will We Be Able To Finance Against Our Rare Collectibles?

As more liquidity enters this market from a consumer lens, and institutional investors start parking their money in picks-and-shovels businesses and rare assets to hedge against inflation, the last question that comes to mind is:

Will we ever be able to lend & borrow against our prized possessions?

The concept is straightforward: turn collectibles into an asset-backed loan where the lender underwrites the collateral (the collectible) more than your income/credit, and ‘controls’ the asset until you repay.

The short answer is: people are building this now.

Alt - a collectibles company with a star studded cap table of Seven Seven Six, Tom Brady, Giannis, among others has created a lending product for cards where collectors can get a loan or a cash advance on their portfolio.

Other interesting players offering similar value props are PWCC Capital, Collateral Finance Corporation (CFC) & JM Bullion Partnership, Qollateral, and Advance.

It’s genuinely exciting to see all of the business developments this industry is experiencing. It’s a space that makes us feel like kids again while also allowing us to put our cultural anthropologist hats on.

If you’re building or investing in this space, we’d love to chat.