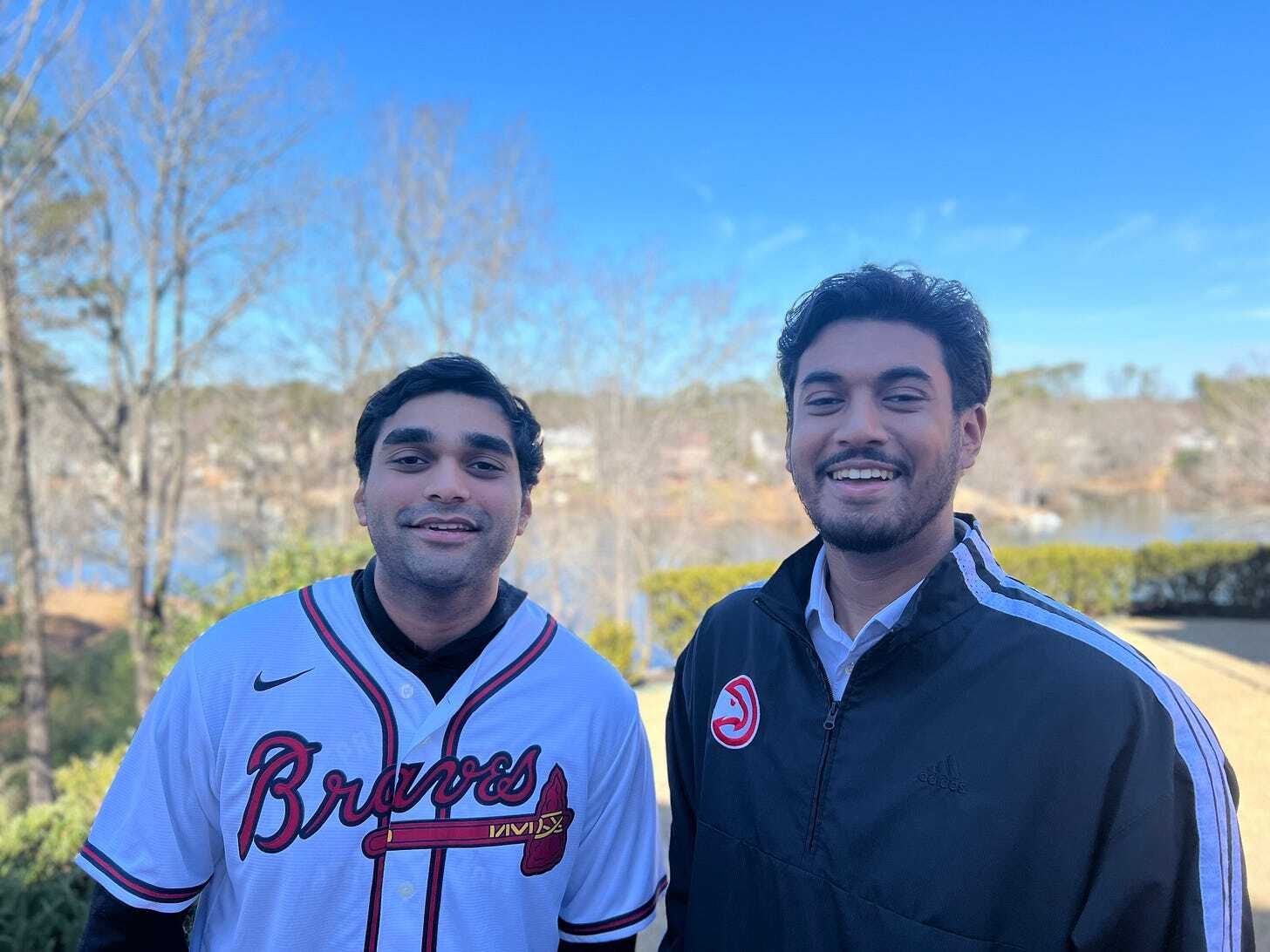

Pictured: left to right: Suraj Peramanu, Sid Balaga.

What is The 4th Quarter?

Welcome! Thank you for reading our very first addition of The 4th Quarter! Our names are Sid Balaga and Suraj Peramanu, two childhood best friends from Atlanta, and we started this newsletter to highlight the cutting-edge innovations & business news surrounding startups and venture capital firms in the sports, technology, entertainment, media, gaming, health, and wellness industries. Sid is currently a sports/media/entertainment Venture Capital Investor @ Phoenix Capital Ventures and Suraj is an Incoming Technology Investment Banker @ Bank of America. Together, we want to bring you 2-4 min bite-sized reads, every Friday, to turbocharge your knowledge in the sports-technology ecosystem. You’ll be smarter than your friends, and have a direct pulse on the innovation.

The Community We Serve

Unlike mainstream sports publications like Sports Business Journal & Front Office Sports, we want The 4th Quarter to showcase up-and-coming technologies that are disrupting the ecosystem, highlight daring founders that are building the future, and provide news on the hottest venture investments. If you are currently a venture capital investor, startup founder, operator, finance professional, student, or enthusiast of the space - this is a no-brainer to subscribe to. Lastly, we’ve included a job board for those looking for new opportunities. With that being said, feel free to connect/message us on LinkedIn; we’d love any feedback and want to hear what you’d like written about! Thanks for being a part of the ride.

Where Sports Startups & Investors are going in 2024

Current State of Sports-Tech Market Activity:

SportsTechX tracked 23 deals which entailed $60.4M in total VC funding, $406.6M in M&A deals in Jan. 2024

Significantly less total investment vs. Nov. & Dec. 2023, which cleared $175M

68% of venture funding and 98% M&A took place in the US

According to Global SportsTech VC Report 2023, $2B in Global Funding & 6 new unicorns emerged

34 New Sports Funds amassed $4B in dry powder

28% of funding went towards Hardware Fitness startups

The evidence depicts that 2023 was the lowest funding year since 2015; and conversely, the largest year in the sector’s M&A with $31B in announced deal value.

Breakdown of Startup Investments:

Although 2023 was the year of consolidation for sports-tech companies, there were still some early-stage investing. It can be broken down into startups building for Athletes, Fans, or Executives.

‘For Athletes’ startups received 42% of the funding

‘For Fans’ startups received 47% of the funding

‘For Executives’ startups received 11% of venture funding.

Founders, operators, and venture capitalists are consistently prioritizing fan experience & end-user technologies in this domain; since 2019, fan and content-focused solutions amassed $30B in total investment. In a venture capital environment where B2B solutions are becoming increasingly popular, the sports-technology vertical proves that there is still white space on the D2C front.

Private Equity Firms Supercharging M&A:

Sports franchises are prime investment opportunities due to soaring franchise values and consistent cashflows generated from broadcasting and franchise sponsorships. However, private equity firms haven’t been able to invest until recently, as sports leagues (except the NFL) have slowly but surely permitted PE shops to acquire passive stakes in franchises. According to Pitchbook, 33+% of U.S. men’s sports teams are now tied to private equity groups!

The four pillars that attract PE firms in the sports sector are:

Streaming: Subscription-based models & global reach have established a consistent basis for cash flows

Sports-Betting: Deregulation and abundance of data analytics have accelerated viewership

Sponsorships: Long-term partnerships with innovative brands have lead to substantial revenue boosts for sports franchises

Intellectual Property: Owning & uniquely monetizing IP (broadcast rights, distribution, etc.) has built additional revenue streams

Sports-Tech Market Activity: Investors & Deals

Every week, we will aggregate the latest news related to VC, M&A, IPO, and strategic ventures and deliver it to you in an easily-digestible bullet points. We hope that you can use this to stay-up-to-date in a rapidly changing space.

Venture Capital

Splash Inc., a real-money gaming platform, raised $14.1M in a Series A2 funding round

Expanding its peer-to-peer sports gaming platform and launching its marketing arm Splash Inc. Partner Solutions

Investors include Boston Seed, Velvet Sea Ventures, K5, Elysian Park, Acies Investments, Accomplice VC, and Counterview Capital [FinSMEs]

TextQL, a state-of-the-art data analytics platform, raised $4.1M in pre-seed funding

Recently partnered with NBA Launchpad, accelerating the NBA’s data platforms to an AI-native path

GamePLAI, an AI-based sports analytics and forecasting company, raised a $1.9M investment

Reflo, a sports apparel brand that specializes in sustainability clothing, raised £1M (~$1.25M)

Seed round was led by Bayern Munich’s superstar Harry Kane [Insider Sports]

M&A and Investments

Strategic Sports Group (SSG) invested $3B in the PGA Tour Enterprises, valuing the company at approximately $12B

Considered a players-first initiative as key investors are inclined to help PGA Tour improve its business operations to make more money for players [SBJ]

Baltimore Orioles ownership agreed to sell the team to a private equity group led by David Rubenstein (Carlyle) and Mike Arougheti (Ares) for $1.725B

PE group will initially own 40% of the team but will buy the rest of the equity after patriarch Peter Angelos passes away [FOS]

GoPro has agreed to acquire Forcite, a leading developer of tech-infused helmets specifically for motorcyclists

Acquisition will accelerate GoPro’s brand presence in the motorsports industry [PR Newswire]

Online betting/gaming platform FairPlay Sports Media, has acquired Quarter4 (Q4), a sports-focused prediction platform

Q4’s data solutions will be critical in launching the company’s BetTech product [Insider Sports]

IPO and Direct Listings

1/30/24 - FanDuel parent company Flutter Entertainment was officially listed on the New York Stock Exchange, moving its primary listing from London to the NYSE

Strategic move to make FanDuel stock more accessible to US-based investors as it’s the most used sportsbook in the U.S [FOS]

2/1/24 - Amer Sports, a Finnish sports equipment conglomerate with subsidiaries such as Wilson Sporting Goods, went public on NYSE

Raised ~$1.37B through the IPO. [SBJ]

Strategic Ventures

Lebron James & DraftKings announce talent partnership to provide exclusive content such as weekly football and fantasy picks [DraftKings]

Pictured: Rob Gronkowski celebrating Flutter Entertainment’s public listing on the NYSE.

Weekly Startup Spotlight

We eventually hope for this section to be a unique platform for founders to raise capital & VCs to scout the next unicorns. Check out:

Pickleheads - Consumer-tech platform to help connect pickleball players to each other and to local courts. One of the only leading tech players in the pickleball space, and as of Jan. 2024, the company surpassed 100,000 users!

Founders: Max Ade, Ian Langworth, Brandon Mackie

Funding: Raised $750K pre-seed round in 2022 from Boardroom, Overline VC, & Ardent Venture Partners

Pepper - Revolutionizing electric muscle stimulation (EMS) training by making it easy and flexible with a wireless dry-electrode suit and software training app component. Based out of Munich, Pepper has Beta launched with 500+ users, strong unit economics, high user retention, and a solid six-figure revenue!

Founder: Emilia Keyserlingk

Funding: Raised $315K Angel Round to validate the idea, currently seeking next raise

*If you are building, operating, or would like to recommend a startup to be showcased, please shoot me a DM on LinkedIn: Sid Balaga.

Job Board & Opportunities

The job board is personally curated for openings that are not widely posted. Spanning business development to software engineering and everything in between - entry level jobs to senior leadership - here’s to those looking for new opportunities in 2024: