Before we dive in, check out our latest podcast with former NFL players turned sports-tech entrepreneurs Kenyon Rasheed & Brian Jones!

After both having a stint in the NFL, Kenyon and BJ successfully built and sold Edge3, an AI-powered digital advisory platform that connected high school athletes with the right college athletic programs. Their company was acquired by Next League, the leading digital growth and tech consultancy in sports, where they now run the College Sports division.

Some cool facts about our guests:

Kenyon served as the captain of the Oklahoma Sooners football team

Brian is a well-known TV personality - you can catch him analyzing college football every Saturday on CBS Sports during the season!

Now let’s dive in…

How CPG Wellness Brands Can Be VC-Backed: Protein Soda

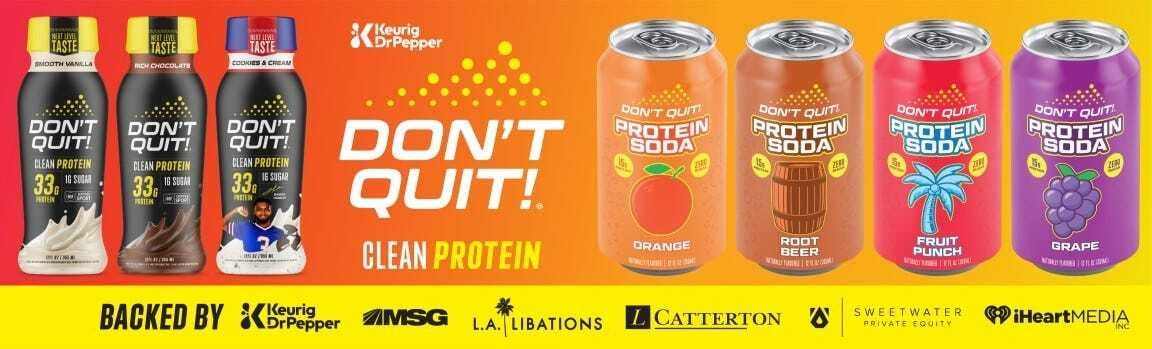

This week was an interesting one for the consumer product goods world - Don’t Quit, a brand known for its protein shakes and energy drinks and soon launching a protein soda, raised $15M in funding from Solyco Capital.

We’re not too surprised by how much capital flows into these types of consumer goods, especially considering the sheer size of these markets: the global energy drink market hit $107.2B in 2024 and projected to reach $223.4B by 2033 while protein-related product market was valued at $10.5B in 2024 and projected to grow at an 8.7% CAGR. While the numbers tell a promising story on paper, the macro-shift towards more protein dense lifestyles is what makes this a unique one.

We are interested in how early-stage CPG wellness brands attract so much VC/PE money. It seems like an extraordinarily difficult task to successfully scale an early-stage beverage brand:

Market Saturation: There are million different competitors in the beverage space, and it's the dominant, name brands that have a stronghold on the market - stealing market share is an up-hill battle, as they have an edge on brand recognition and cost efficiencies through economies of scale

Product Differentiation: Consumers have a tough time differentiating one drink’s taste to another - branding influences taste perception more than the taste itself

So, what makes a CPG wellness brand venture-backable?

Our Four Box Checklist

A CPG wellness startup needs to check at least three of the four boxes to attract VC/PE interest:

Premium Product: It is essential that the startup’s drink / snack actually tastes good - good enough that the core ideal customer profile (ICP) keeps coming back for more. Otherwise, it won’t be sticky in the long-run.

A premium offering = premium pricing = better margins.

Critical Mass Distribution: The product needs to get to consumers at scale, whether it’s a) traditional retail - Walmart, Target, Sprouts, etc. or b) e-commerce backed by a powerful GTM flywheel via social media & influencer marketing.

Real Consumer Utility: In a saturated market, having an x-factor is key - like OLIPOP and Poppi with prebiotic soda. Consumers now want products that are useful - such as the added health benefits.

Economies of Scale: Unlike software that has low scaling costs, CPG businesses have physical product costs such as raw materials, inventory, labor, & shipping that make it harder. A VC opportunity only exists if enough product is manufactured & sold so each unit’s individual cost is lower.

Does Don’t Quit Check All the Boxes?

It definitely checks boxes 2) and 3).

Guaranteed Product Distribution via Partners

Don’t Quit has two major partnerships that ensure GTM access to their ICP:

Keurig Dr Pepper, which owns a controlling stake in Don’t Quit, unlocks relationships with established retailers - their new protein soda will officially launch in Walmart and Albertsons on July 1st

MSG Sports, who led the previous $10M funding round, opens up powerful distribution through sports-related channels. Now that their protein shakes are NSF certified, Don’t Quit can now place their shakes in MLB locker rooms, a big boost for their brand recognition

A New Product Category - Protein Sodas

Don’t Quit’s patent-protected, carbonated, ready-to-drink protein soda is the first of its kind to hit the mass market. Unlike their shakes or energy drinks, the new product line gives them a true first-mover advantage - with no direct competition anytime soon.

What about Box 1)?

We’ll have to wait and see.

CEO Mark French says retailers jumped at the opportunity, which signals strong upside. But the real test is consumer reception.

It’s a boom-or-bust play: If the product tastes great and catches on, it could easily become a $1B+ brand. If not, it’s going to be a tough outing for new investors.

Sports-Tech Market Activity: Investors & Deals

New Funds

Symphony Ventures partners with TPG to launch investment fund targeting sports industry investments (May 1st)

Fund to be led by operating partners Rory McIlroy and Sean O’Flaherty, co-founders of Symphony

Secured financing commitments from Lunate, a $110B AUM Abu Dhabi-based alternative investment manager

Symphony’s previous investments in sports include golf ventures Golf Genius and Puttery [Businesswire]

Red Bull targets tech, sport, and sustainability in launch of corporate VC fund, ‘Red Bull Ventures’ (Apr. 25th)

Media reports rumor a €200M fund size, although not yet confirmed by company

Previously indirectly invested in startups as an LP of other VCs, including Speedinvest, Fund F, and 3VC among others [Startup Kitchen]

Venture Capital

Fanstake, an NIL crowdfunding platform that allows fans to support athletes’ endorsement deals, raised $6.25M in Seed funding (Apr. 29th)

Funding product development, gamified rewards elements, and expanding beyond its affluent donor customer base

Investment led by Courtside VC; other investors include Will Ventures, Susa Ventures, and Scrum Ventures, among others [Sportico]

Don't Quit, a sports nutrition company that provides clean hydration beverages, set to close $15M in funding round (Apr. 29th)

Meanwhile, launching new line of protein sodas, set to launch this July

Investment led by Solyco Capital; follows a $10M round led by MSG Sports [SBJ]

GORGIE, a New York City-based wellness energy drink brand, raised $24.5M in Series A funding (Apr. 29th)

Offers clean-label, functional beverages with ingredients like green tea caffeine, L-Theanine, and B vitamins - targeting health-conscious consumers

Investment was led by Notable Capital; other investors include Coefficient Capital and angels Jason Cohen and Yossi Nasser [FinSMEs]

Pallie AI, a San Francisco-based AI companion platform focused on health and wellbeing, raised $2M in pre-seed funding (Apr. 30th)

Offers personalized, human-like interactions to address loneliness and promote healthier lifestyles, integrating Apple Health data for tailored recommendations

Investment was led by True Ventures with participation from Palta [FinSMEs]

Respondology, a social media moderator that hides hateful, spam comments for brands, leagues, and teams, raised $5M in Series A-1 funding (Apr. 24th)

Funding PD of ‘Respond’, an automated response product for fans' comments and questions, and hiring across AI engineering, sales, and marketing teams

Investment led by Iron Gate Capital and SJF Ventures; other investors include Zelkova Ventures, Boulder Heavy Industries, and RLB Holdings [SBJ]

M&A and Investments

Washington Commanders strike $3.7B deal with D.C. for RFK Stadium, set to upgrade to 65K-seated venue (Apr. 28th)

Funding coming primarily from Commanders ($2.7B) and taxpayers ($500M)

Anticipated construction set to begin next year, with hopes of 2030 opening [SBJ]

Eli Manning reportedly assembling a bid to acquire NY Giants minority stake (Apr. 29th)

Coming months after the Giants’ comments on potential minority sale earlier this year

Interested investors may include former NFL players who would join Tom Brady as players-turned-owners following his 10% Raiders stake [On3]

On3 ownership company acquires college/high-school coverage platform, Rivals, partners with Yahoo (Apr. 30th)

Deal set to close by end of Q2 2025

Yahoo Sports to take ownership stake in On3 parent company

On3, Rival to create a network across both platforms covering college/HS sports, recruiting, and NIL among other areas [FOS]

PE firm CVC acquires stake in mobile game developer Dream Games to develop ‘Royal Universe’ (May 1st)

Dream games regarded for its popular titles Royal Match and Royal Kingdom

Aims to provide initial liquidity to the developer, with expected exit after 5 years [CVC]

WME Sports, a leading talent representation firm, to divest its basketball representation division due to conflict of interest (Apr. 29th)

Conflict roots from Michael Dell’s family office’s 10% Spurs stake alongside investing in Endeavor Group, WME’s parent company

Division to hold onto current roster, including Anthony Edwards, Luka Dončić, and Sabrina Ionescu among others

WME execs Ari Emmanuel and Mark Shapiro expected to invest in the new standalone unit [SBJ]

Orlando Dreamers secures $1.5B in funding in move to bring MLB franchise to Orlando (Apr. 25th)

Dreamers led by National Baseball Hall of Famer, Barry Larkin

Reportedly eyeing Tampa Bay Rays or an MLB expansion team for acquisition

Additionally, planning to fund a $1.7B, 35.5-acre domed ballpark in Orange County [SBJ]

Premier League club AFC Bournemouth acquires Vitality Stadium from real estate firm Structadene (Apr. 25th)

Plans to expand and renovate the 11.3 K-seated venue

Black Knight Stadium Limited, a newly created entity, will hold ownership of the venue

Black Knight Football Club, owner of Bournemouth, reacquires the stadium after selling it back in 2005 [AFC]

Wenger Corporation, a manufacturer of high-quality equipment largely for music and theatre, acquires stage automation tech company Creative Conners (Apr. 28th)

Enhancing Wenger’s range of solutions for the performance arts sector

Creative Crooners’ operations to continue in Rhode Island, leading to team integration in the coming months [FinSMEs]

Photo Creds: Red Bull will launch a corporate venture arm to invest in the future sports-tech and sustainability.

Strategic Ventures

NCAA expands partnership with sports insights company Genius Sports to sell to licensed sportsbooks (Apr. 25th)

Grants Genius Sports rights to sell data from NCAA championships through 2032

NCAA holds the right to revoke sportsbook licenses in case of integrity protections violations [Sportico]

Kevin Durant’s Boardroom announces partnership with MLB following successful 2024 collaboration (Apr. 28th)

Boardroom to spearhead functions within Fanatics Fest, MLB All-Star Celebrity Softball, and MLB Awards presented by MGM Rewards After Party among others [MLB]

USL Super League, a new top-tier women’s soccer league in the US, partners with performance intelligence company Kitman Labs for league-wide data centralization (Apr. 30th)

Supporting the league’s inaugural season as it competes with the NWSL

Targeting player health, wellness, and performance data through the company’s performance medicine system [Inside World Football]

ASU launches SPORTx, an initiative to stimulate athlete engagement and venture development (Apr. 30th)

Student-athlete-focused program to stimulate entrepreneurial endeavors in sports innovation

Collaborating with Empower by GoDaddy and sports/health-tech VC LEAD Venture Corp [ASU]

Job Board & Opportunities: Week of May 2nd

Here are some cool roles we found and personally curated this week - enjoy!

Our favorite this week - Next 3 - Sports Venture & Growth Investor: 10-12+ Years