FEATURED STORY

Three Biggest Business Takeaways for Super Bowl LX

As we’re putting the finishing touches on this week’s piece from a JetBlue Airbus touching down in SFO from New York’s JFK, we initially struggled to pin down just one topic to write about behind the business of the Super Bowl.

Yes, the low-hanging fruit here is to talk about the estimated $440M the Super Bowl is set to bring into San Francisco. And of course The 4th Quarter will be contributing to the local tourism economy with a few In-N-Out burgers.

But, there’s no shortage of storylines leading up to the big event: Anthropic & OpenAI preparing to wage war during commercial break, Belichick & Kraft missing the Hall, and the Pro Bowl making its Super Bowl Week debut for the first time.

So this week, instead of going deep on just one angle, we’re covering the three most unique business developments surrounding this year’s Super Bowl - each with implications that extend well beyond Sunday:

Brands Should Let Content Creators Produce Their Super Bowl Ads

Sportsbooks Showed Their Dominance By NFL’s Ban on Prediction Markets Marketing

Seahawks Sale is a Litmus Test for Buyer Interest in Professional Teams

Here’s why you should be paying attention.

Brands Should Let Creators Produce Their Super Bowl Ads

You’ve probably heard the news by now: MrBeast is starring (and producing!) in a Super Bowl commercial through a collaboration with Salesforce. A month ago, the billionaire YouTuber posted on X that he was looking for a brand willing to collaborate on an “amazing Super Bowl commercial idea.”

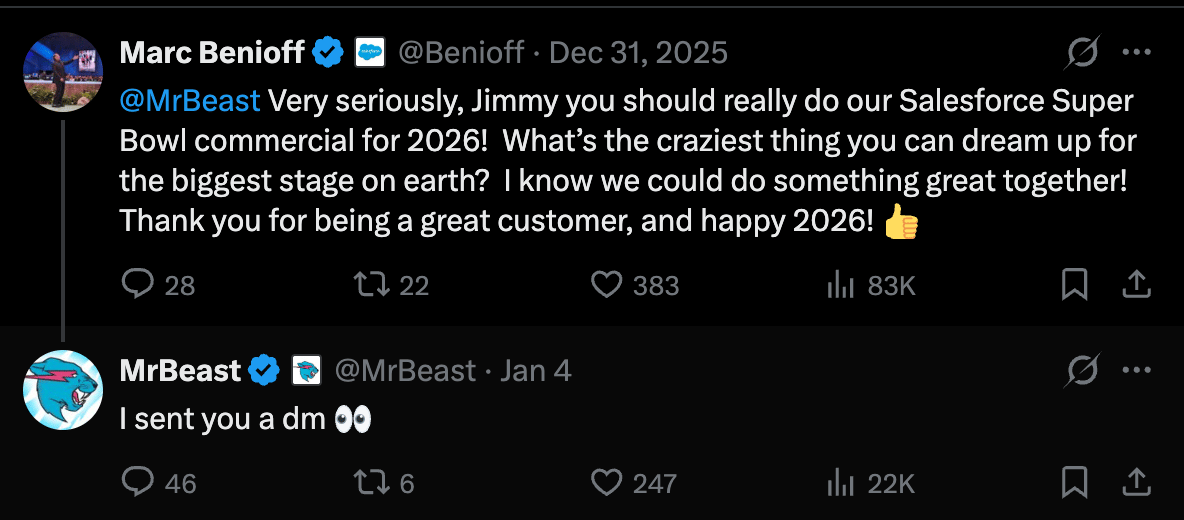

Salesforce CEO Marc Benioff immediately seized the opportunity:

From there, MrBeast did what he does best: generate absurd levels of hype. He posted behind-the-scenes footage from the production and teased that watching the ad live during the Super Bowl could make someone a millionaire.

The Super Bowl has always been the moment for brands to swing big and embrace creative eccentricity. But this is unusual.

Historically, Super Bowl ads have leaned on celebrity cameos. Recently, creators have started to appear, with Alix Earle debuting last year in Poppi and Carl’s Jr. ads and Speed appearing in this year’s Meta x Oakley spot.

Those are just cameos. MrBeast ideated, pitched, and produced this Salesforce ad himself - setting a new precedent for creator-produced marketing, not just for Super Bowl ads, but for brand marketing more broadly.

Think about it. Creator-led advertising is now a core pillar to a brand’s GTM strategy:

Top creators rely on sponsorships to survive, but they also obsess over delivering value to their audiences and mastering attention. Give them full creative discretion, and they will stand as long-term partners, consistently delivering bespoke ads that’s difficult for celebrities to match.

So the natural question becomes: why shouldn’t creators just be the brand’s marketing engine?

MrBeast alone reaches over 1B people across social platforms. In many cases, he outperforms entire marketing teams on trust, reach, and creative execution with a single post. It’s not crazy to imagine a world where he builds an out-of-the-box marketing agency - viralizing the brands he partners with long-term.

He’s already doing it with Salesforce. And in the process, he’s sharing BTS footage showing how he used Slack to produce a Super Bowl commercial in under 27 days.

Not a hot take: if your brand isn’t considering partnering with mega-creators for Super Bowl ads, you’re already behind.

Give a top creator full marketing discretion now, and you may ship the most effective campaign your marketing team has ever produced.

Sportsbooks Still Reign Supreme, Thanks to the NFL

The NFL banned prediction markets (Kalshi and Polymarket included) from running Super Bowl commercials, placing them on its “prohibited” list alongside firearms and tobacco. It’s a notable shift in tone, especially given the recent partnerships Kalshi and Polymarket have struck with MLS and the NHL.

The Super Bowl is a brand’s most direct line to the American heartland. With an audience of 120M+ viewers, you’re reaching the Gen-X Midwest football lifer loyal to his sportsbook who may suddenly wonder if it’s worth buying an event contract on whether Chris Collinsworth says “Mahomes-like” during the game.

There’s no denying prediction markets pose a real threat to traditional sportsbooks - just look at DraftKings and FanDuel stock performance over the past year. The pressure has been real enough that sportsbooks are now experimenting with their own prediction-market-style products to gain access to event contracts they can’t offer inside a traditional sportsbook.

But here’s the more accurate framing: prediction markets don’t replace sportsbooks - they narrow their TAM.

They’re capturing Gen Z and Gen Alpha users just entering betting, along with information-first bettors who care more about arbitrage and market efficiency than parlays and game lines.

In contrast, 59% of Gen X & older are familiar with DraftKings, compared to only 4% for Polymarket.

Meanwhile, the sports betting sharks, parlay hunters, and mainstream American sports fans are sticking with sportsbooks because they:

Aren’t familiar with prediction markets

Don’t care to “invest” in events beyond sports outcomes

Have built enough product loyalty to never leave FanDuel or DraftKings

The American Gaming Association projects $1.76B will be wagered on the Super Bowl through U.S. sportsbooks this year - a 27% year-over-year increase. Slightly biased source, but historically reliable.

Kalshi, to be fair, is doing just fine. Super Bowl-related trading volume has already crossed 160M+, a meaningful jump from its event-contract debut last year. But the momentum is complicated by a recent report (note: currently disputed by Kalshi) showing the bottom quartile of Kalshi users lost 28 cents per dollar bet in their first three months - more than double the ~11 cents lost by comparable users on DraftKings and FanDuel.

That might make it even harder to convert the average sports fan or novice bettor onto prediction markets.

It’s simply a different demographic and likely remains that way in the near future.

At the end of the day, the NFL is a very powerful safeguard for sportsbooks. There’s no better league for reaching FanDuel, DraftKings, and Fanatics Sportsbook’s core customers. And with DraftKings and Fanatics confirmed to be running Super Bowl ads of their own, that grip only tightens.

Sportsbooks should keep the NFL happy. It’s one of their strongest defensive moats.

Seahawks Sale Is a Litmus Test for Buyer Interest in Professional Teams

The Wall Street Journal recently reported that the Seattle Seahawks could enter a sales process shortly after the season ends - quite unprecedented given that they’re literal favorites for the big game this weekend.

The origins of the sale are complicated. Following his death in 2018, late Microsoft co-founder Paul Allen placed the Seahawks into a trust managed by his sister, Jody Allen. But under NFL governance rules, a franchise must be controlled by an individual, not a trust. The league quietly fined the Seahawks $5M over the structure, an issue that now appears resolved.

What matters more to us is the price tag.

Recent minority stakes sales in NFL teams have reached north of $9B (Patriots, Niners) and even $10B (Giants). The last majority sale was the Commanders, closing for $6B in 2023.

Now, speculation is that the Seahawks could sell for as much as $8B. That raises a fundamental question: who actually buys at that level?

One path is another single-check owner. Given Seattle’s tech ecosystem, it’s easy to imagine a major tech billionaire stepping in - Bezos, Ballmer, or someone similar - with the capital to acquire the team outright.

The other path is more interesting.

When the Commanders sold, private equity firms weren’t permitted to own minority stakes in NFL teams. That rule has since changed. Could we see a billionaire-led consortium, supported by multiple PE firms, become a far-more viable ownership structure long-term for the NFL?

It’s unclear till the sales process happens.

But one thing’s for sure: if potential buyers thin at $8B+, the argument for PE firms owning higher stakes becomes that much stronger.